Payment solutions are definitely still needed across all industries. But the impact of COVID on payment solutions can't be ignored. Though downtrends have been seen, there are areas for growth when it comes to payment solutions, creating a FinTech gap.

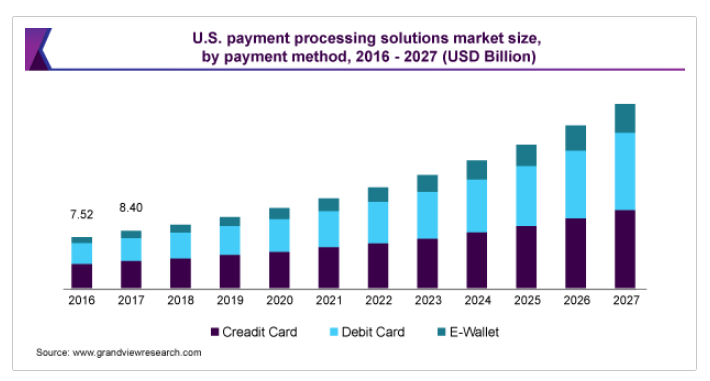

In 2019, the global payment solutions industry was valued at $33.45 billion, according to a Grand View Research report. Compound annual growth rate (CAGR) was estimated to be 14.5 percent from 2020 to 2027.

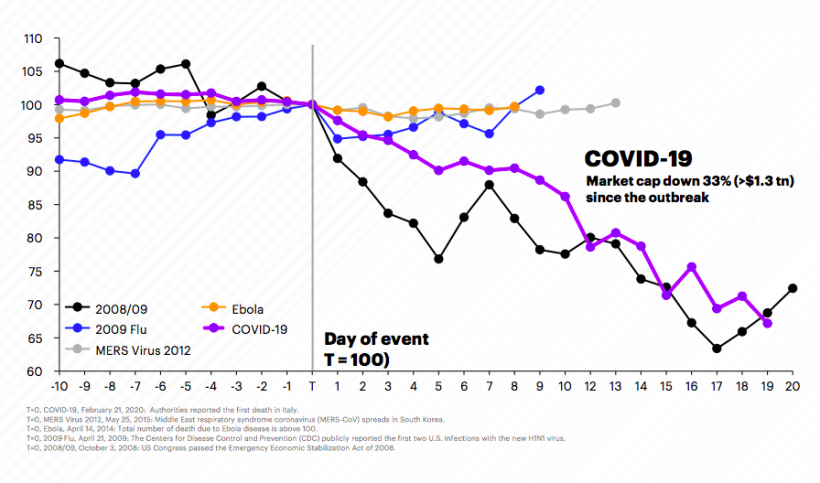

But 2020 was not a normal year, and the COVID pandemic may be causing significant issues in certain payment solutions areas. For example, the global market cap has decreased 33 percent during COVID.

The decrease in market cap is almost as profound as the recession of 2008/2009. This is certainly cause for concern.

In some cases, however, the COVID pandemic has increased the need for digital payment solutions, like MXTM QuickBooks Sync, because online payments allows for greater social distancing.

"Manually tracking sales data can become an accounting nightmare," Angelo Mendola, COO of Priority Payments Local, explained. "With MXTM QuickBooks Sync, merchants can synchronize financial data from the MXTM Merchant payment platform to Intuit's QuickBooks Online tool."

This is an example of filling FinTech gaps ushered in by COVID, and the COVID guidelines and restrictions enacted by state and federal governments.

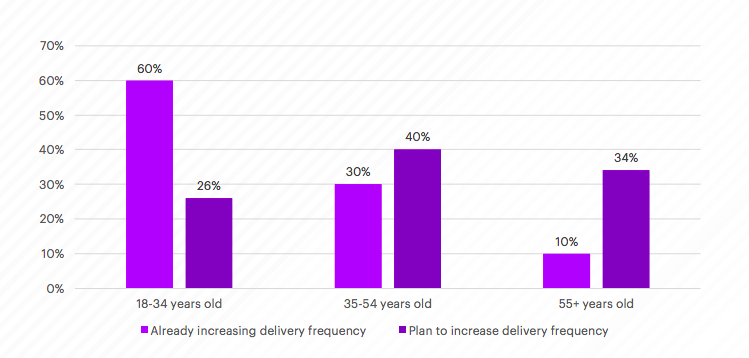

Contactless payments are essential during the pandemic as well. The need for contactless payments within food delivery and pickup is another major gap that has been a focus for payment solutions companies, according to an Accenture study.

The following will dive deeper into the impact COVID-19 has on the payment solutions industry.

Card Payments Replacing Cash During COVID Pandemic

There have been no shortage of card payments during the COVID pandemic. In fact, contactless payments via cards have increased by 69 percent since January 2020. This can be attributed to the fear in handling cash by consumers and businesses.

The fear of handling cash during the pandemic has also decreased ATM use by over 30 percent, according to ATM transaction research. Even state governments and organizations have made shifts to card only, like toll services across states like Ohio, Michigan, Florida, and other states.

The increase in card payments, especially contactless payments via cards, is a good sign for the payment solutions industry. More businesses want to streamline the card payment process in order to better serve customers, as well as make transaction record keeping and analytics simplified.

The use of cards, and less use of cash, is not a new trend. There were already major shifts in cashless payments across the board pre-pandemic. In a way, COVID sped up the shifts, and created a need for finding no contact payment innovations.

One major pain point for businesses adapting to card only transactions is the fees merchants are charged when credit cards are used. Payment solutions that reduce merchant card fees may find a profitable FinTech gap.

The National Retail Federation explained, "But a higher fee of about 2.8 percent is charged if the same card is used online or over the phone. With the increase in purchases paid for that way but picked up in-store, retailers are expected to pay about $1.6 billion more this year."

Card and cashless payments will definitely continue to surge during the pandemic, and post-pandemic. Even small businesses are adapting to card payments, meeting the new demand for less cash handling.

Mobile Payments May Be The Future Post-Pandemic

Mobile banking payments increased by 50 percent since the beginning of 2020, marking potential for mobile banking to be the future of payment processing during COVID and post-pandemic.

Mobile banking might be even more popular than credit card and debit card transactions during the pandemic. And this could continue after COVID subsides. For instance, more than half of consumers believe that mobile banking creates greater financial stability than using traditional financial institutions.

This is not surprising due to the restrictions and guidelines the pandemic has ushered in. With contactless payments needed, digital and mobile payment processing would appear to be the favorite form of transactions among consumers and businesses.

Mobile banking also allows users to send money to friends and family, instead of writing checks or waiting lengthy transaction times for traditional financial institutions to process bank transfers.

The fastest way to get money to friends and family these days is indeed mobile banking, like P2P transfers via Zelle. The current pandemic has caused a hallmark period for mobile banking, leaving a FinTech gap for P2P mobile payment solutions that make sense during COVID and post-pandemic.

Mobile banking is essentially social-distancing friendly. Mobile wallet payments, QR codes, tap payments, and facial recognition payments are all areas to explore within the payment solutions industry.

Consumers Are Shifting To Brands With Greater Customer Rewards

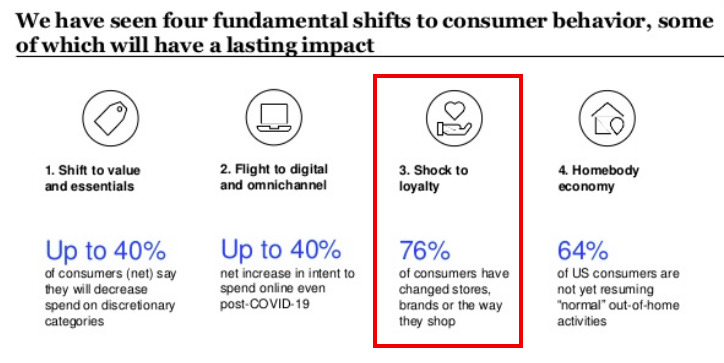

Consumer behavior has definitely shifted during COVID. The beginning of the pandemic saw consumers going on buying sprees for essential products, like toilet paper, meat, disinfecting supplies, and other items.

The pandemic created an unprecedented hoarding of essentials that businesses, even major brands, have never had to confront before. When go-to brands and ecommerce companies, like Amazon and Walmart ran out of what consumers needed, consumers went elsewhere.

This made customer loyalty and rewards programs within payments important. According to a McKinsey report, 76 percent of consumers switched up brands and the way they spend during the COVID pandemic.

The change in the brands when it comes to consumer shopping behavior can be attributed to the lack of products consumers needed during the first wave of the pandemic.

The businesses online that served up better customer loyalty programs and rewards for money spent saw massive upticks in profits. The payment solutions used by these brands and businesses needed to shift to meet these needs.

The businesses that utilized mobile wallet payments solutions that emphasized customer loyalty and rewards saw the greatest increases in revenue. And these retailers will most likely continue to see increases as the pandemic continues to disrupt product availability.

Wrapping Up . . .

COVID has impacted the payment solutions industry on multiple levels. In some areas, the pandemic has had a negative impact on payment providers. However, there are areas of growth that have left FinTech gaps payment solutions providers can innovate and fill.

The end is not in sight, and consumer behavior and the ways consumers spend will certainly keep shifting. Mobile banking and the use of cards over cash will certainly be on the rise as social distancing and contactless payments are needed. Retailers that meet the current needs of consumers will find the greatest value.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com