The 21st Century has seen many developments in technology that's made stock market investing more accessible than ever before. But in the wake of the GameStop and Robinhood fiasco, it appears that Wall Street is still far from inclusive.

In January 2021, the US video game retailer found itself at the center of a battleground between a Reddit group consisting of amateur traders and wealthy hedge funds. The social surge in GameStop's stocks may well have begun as a nostalgia-based joke, but it ultimately wrecked one Wall Street hedge fund and made some investors extremely wealthy in a matter of hours.

Now, two months on, the dust is still settling from the events that day. In what some market commentators likened to the 'French Revolution of finance', the trading apps like Robinhood that gave casual traders a platform to buy and sell shares suddenly reacted to the event by restricting accounts.

As retail investors found themselves blocked from trading in at least 13 stocks within their Robinhood, the free-trading app that's intent on attracting younger investors, it became clear that this financial revolution had been quickly quashed in favour of Wall Street's old guard.

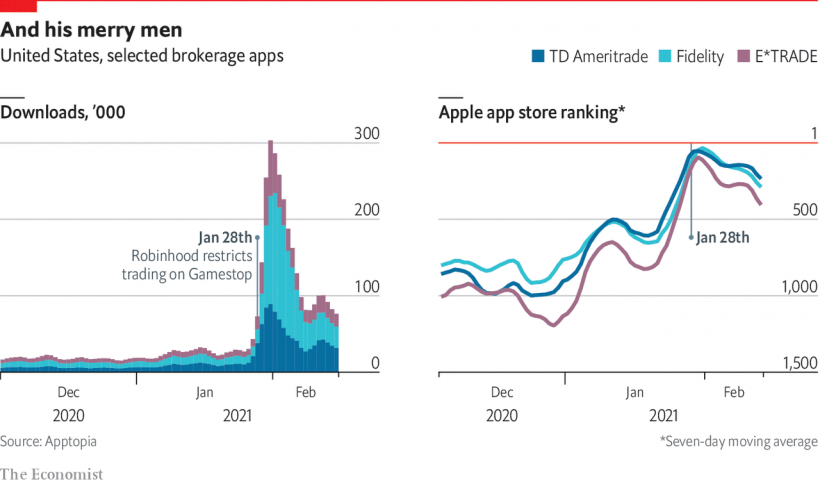

While Robinhood's measures to limit the movement of traders became a focal point of the saga, it's worth noting that other retail brokerages, including TD Ameritrade, had prevented users from buying shares, only allowing sales to take place.

(Image: The Economist)

The GameStop rally quickly became international news, and as we can see from the chart above, it inspired a significant number of downloads among legacy brokerage apps in the US as investors looked to abandon Robinhood for new frontiers.

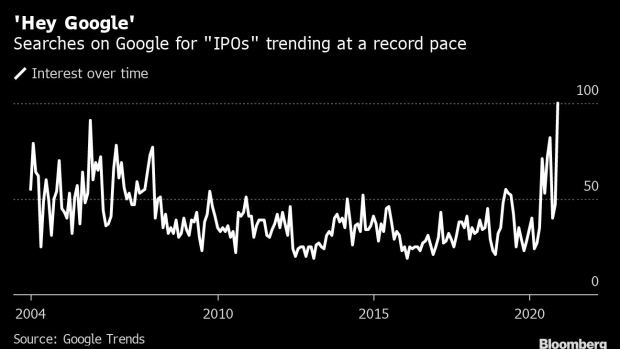

However, with clear evidence of this peak in popularity already showing signs of waning, could investors find themselves looking at new ways to earn profits away from the confines of Wall Street? In an era that's seen a renaissance in the volume of tech IPOs entering the market, could we see investors looking to trust their money in companies as they prepare to go public?

Fighting The Influence of Hedge Funds

The problem with retail investing is that it's rare to record wins against hedge funds. Especially when some organizations like Mudrick Capital are concentrating a proportion of its $2.7 billion in assets towards Reddit-driven stocks. In January, the firm recorded a 9.8% gain, and it wasn't the only hedge fund to profit from social investors. Senvest Management, a contrarian, deep-value hedge fund performed even better than its counterpart, reportedly booking $700 in profits on GameStop alone.

It can be extremely difficult to beat the house when it comes to Wall Street. The deep pockets and heavy resources of full-time professionals with teams of people competing against retail investors can be overwhelming. In fact, it often means that active traders can underperform when compared to inactive traders.

According to research from Terrence Odean and Brad Barber, aggressive traders like those who looked to buy and sell their GameStop shares at the right time generally performed far worse than buy-and-hold investors who rarely traded. According to the data, the 20% of most active traders underperformed the least active 20% of traders by around 5.5% on a yearly basis.

With this in mind, the stock markets have continually proven that the door's closed for even the most ambitious of traders.

The Lure of The IPO

In the immediate aftermath of GameStop, the cryptocurrency market experienced a peak in interest as traders looked to distance themselves from Wall Street and embrace more decentralized markets. However, the past year has seen huge optimism develop surrounding tech stocks which has led to a new flurry of IPOs that have captured the imagination of investors.

(Image: Bloomberg)

Interest in the term 'IPOs' has reached its highest peak since the end of the dotcom boom in the late 90s, and it presents a brand new frontier to investors who are looking to sidestep the restrictive world of Wall Street by embracing stocks and shares before companies are publicly floated.

Companies opt to make an initial public offering mainly to raise funds for future growth, but it can also be done to raise awareness in the company itself.

An IPO is a process that allows companies to release shares that can be bought and sold by members of the public and institutional investors via an exchange like the New York Stock Exchange or London Stock Exchange. Good example of an upcoming IPO is Deliveroo IPO - one of the biggest food delivery companies in the UK, which is expected to run on March 31st on LSE (trading as ROO).

When buying this soon-to-be listed company's stock, IPO investors can find themselves among the very first people to invest in the country. Oftentimes, investors opt for IPOs because the initial share price can often offer good value.

However, this isn't always the case, and some IPOs fail to meet their expectations. One of the biggest examples of an underwhelming initial public offering can be found in Casper Sleep, which saw its share pricing range cut from $17-19 dollars to $12-13. The stock has since spent much of its time stuck at around 40% below its lowered IPO price.

Despite this, there are plenty of success stories emanating from recent tech IPOs, and perhaps none more impressive than that of Snowflake, a cloud data warehousing firm backed by Salesforce and Warren Buffett's Berkshire Hathaway. With an initial IPO expectation of between $75-85 dollars per share, Snowflake was quickly revised upwards to $100-110 before launching at $120 per share. Eventually, shares briefly peaked above $300 before retracing - helping to earn the company $3.4 billion from the IPO.

How to Take Part in IPOs

Despite IPOs gaining popularity over recent months, some companies are similarly restrictive regarding who gets their hands on their initial public offering shares. If investors are looking to buy into IPOs, it's best to search the company that they're interested in to see the steps they can take to gain access to shares. However, many companies prefer to welcome institutional investors who can purchase large volumes of shares in a single transaction.

Despite this, there are several platforms out there that are actively working to make IPOs accessible for retail investors as well as members of the public. One endeavour, the Nasdaq-listed retail brokerage Freedom Holding Corp. (NASDAQ: FRHC) offers IPO participation to the general public through its brand, Freedom24. However, investments are made as the result of an application process and a threshold of at least $2,000 is required.

Additionally, more traditional brokerages such as TD Ameritrade and Fidelity also open the door to initial public offerings for investors, but there's a higher threshold attached. For TD Ameritrade, accounts must hold at least $250,000 in value, while Fidelity requires users to have at least $100,000 or $500,000 in household assets.

The fallout of the GameStop saga has shown that there's still a level of inequality within Wall Street despite the rise of technologically advanced trading apps. While hedge funds continue to rule the roost across global stock exchanges, investors can still find value elsewhere - and with the IPO landscape continuing to heat up with more tech companies looking to go public, it may be the perfect opportunity to jump into opportunities before large institutions have the chance to interfere.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com