Earlier this month, Microsoft announced its intent to purchase speech-recognition company Nuance Communications Inc. in an all-cash deal valued at $19.6 billion, acquiring artificial-intelligence technology aimed at helping doctors predict patients' needs and upgrading hospitals' digital record-keeping.

It was Microsoft's largest acquisition since its 2016 purchase of professional networking site, LinkedIn, and another sign that the pandemic has accelerated the convergence of health and technology. This has important implications for the commercial real estate market, particularly the health care sector.

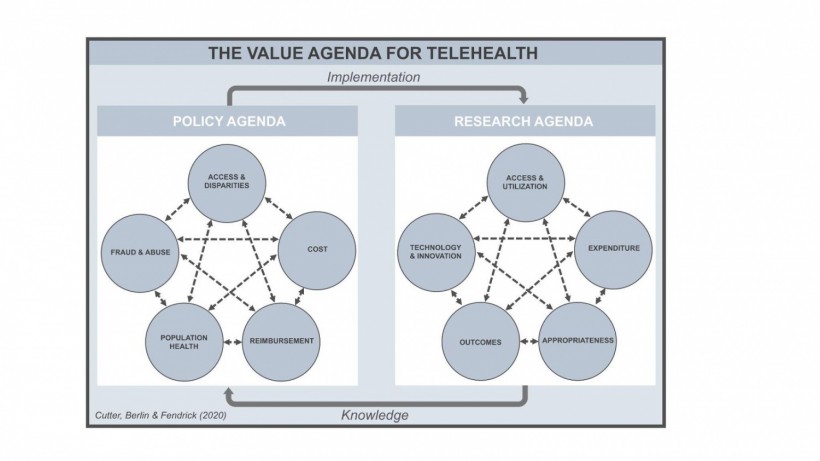

Even in pre-pandemic times, telehealth was growing. Granted, it was a slower and clunkier growth trajectory possibly due to "obstacles including the lack of a consistent payment strategy, unclear relative advantage and implementation scope, education and infrastructure investment requirements, lack of experiential foundation, and concerns surrounding fraud and abuse," according to HealthAffairs.

However, if there was one beneficiary of the pandemic, it was telehealth. Telehealth has surged in the last year with undeniable impacts. For the first time in human history, health-related services and information are available to patients from the comfort of their own homes. Patients that once did not have access to healthcare due to living in remote and underserved areas, now have access to routine appointments. Changes in insurance reimbursement have also expanded the availability of telehealth, with new implications for healthcare real estate occupiers, owners and investors. Sustainable and integrated telehealth is a long-term development that will not reduce healthcare real estate demand. It will actually stimulate it.

"One of the trends that we are monitoring closely is the impact of telemedicine in the United States and how this may impact our acquisition strategy," explains Martin Freeman, CEO of OrbVest, a global real estate company that invests in US income producing medical commercial real estate. Patients are increasingly making use of virtual visits, but still prefer actual 'in person' visits. During COVID patients with chronic conditions have been monitored by doctors over virtual channels. Many medicines still cannot be prescribed online as it is restricted by law. Some forms of healthcare are more adaptable to online settings, like behavioral health services, though the need for in-person visits, labs and imaging will sustain demand for medical office buildings."

Consider these statistics too. According to GlobeSt.com, only about 11% of patients used telemedicine before the pandemic. After the pandemic's arrival, that number climbed to 46%. In other cases, telehealth appointments increased by more than 40 times the original amount.

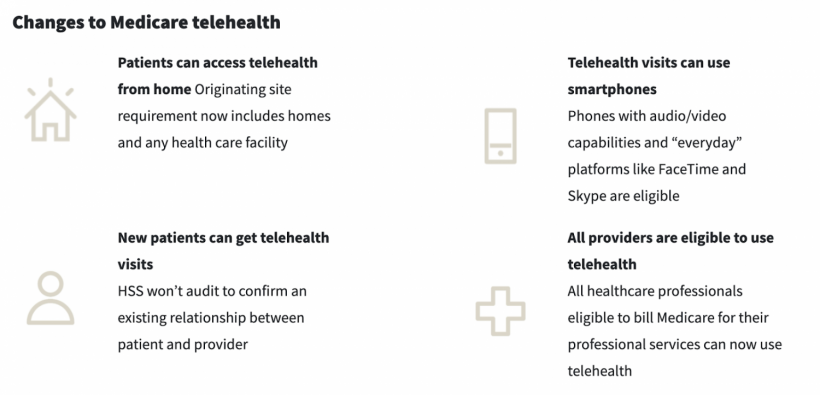

In response to the pandemic, the federal government adjusted payment plan policy and regulations to support greater access to telehealth. They took a pilot program introduced last year that paid for some rural residents to virtually visit their doctor and expanded it nationwide.

Because of how successful Telehealth has been in the last year, hospitals and health systems are looking for ways to make this surging trend supplementary rather than a replacement for on-site care. A recent Forbes article claimed that hospitals in the U.S. are "scrambling" to offer telehealth and home services to supplement lost revenues during the pandemic from lucrative sources such as elective procedures. Fortune Business Insights also believes the telehealth market could be worth $559.52 billion and see a 25.2% CAGR by 2027.

The trend could only grow from here. You have to consider health-driven changes, economic-driven changes, and strategic-driven changes.

Take telehealth giant Teladoc's merger with chronic disease manager Livongo, for example.

Telehealth will inspire redesigns

Redesigns inspired by Telehealth's integration are something to consider when focusing on how accelerating telehealth trends could actually supplement rather than supplant on-site care.

If done correctly, Telehealth can actually maximize productivity per square foot for healthcare providers. There is no universal right or wrong for every healthcare provider and the layout of their facility. But providers will need to accommodate Telehealth, adapt space to their clinical operations, and decide which procedures to make virtual and make in-person. This is the best way they can use Telehealth to their advantage.

Telehealth will increase patient touch points and access

Telehealth will potentially galvanize a need in healthcare real estate by increasing patient touchpoints and providing increased healthcare access. The ease, efficiency, and convenience of Telehealth delivers a more convenient point-of-entry for millions of Americans. It may also increase patient commitment and retention, leading to more in-person appointments.

(Source: JLL)

HBRE's 2020 Mid-Year Healthcare Real Estate Insights echoes this statement and states that Telehealth could lead to an increase in patients. Telehealth has become a critical resource for reaching patients living in remote areas and underserved medically. Many of those patients may eventually need to travel to an in-person facility.

Telehealth has exposed the importance of omni-channel healthcare

Another finding of the Tether Advisors survey was that private equity, commercial real estate, and retail healthcare figures were all relatively aligned on the importance of healthcare adopting an omnichannel approach. An omnichannel strategy involves the successful integration of Telehealth with physical locations.

Private equity respondents to the survey notably showed enthusiasm for brands that have embraced an omnichannel approach during the pandemic. A private equity investor surveyed said, "Virtual [care] now goes hand in hand with a physical presence."

Matt McCambridge, CEO of Eden Health, had some interesting comments on the matter as well. Eden Health is a telemedicine company founded in 2015 that raised $25 million in Series B financing in August 2020 to expand partnerships with commercial real estate firms.

"There is no reason that everything needs to happen in a physical location," said McCambridge. "This only happens because insurance companies reimburse for the physical, rather than virtual, visit. What if we could extract that payment model and focus on the best healthcare?"

Key Takeaway for Investors

Telehealth, AI, and voice recognition technology have positioned healthcare real estate to not only survive the pandemic-induced economic downturn, but thrive as one of the strongest areas of the commercial real estate sector.

"We spend large amounts of our time investigating and understanding the impact of technology and telemedicine on our niche," explains Martin Freeman, CEO of OrbVest, a global real estate company that invests in US income producing medical commercial real estate. "We believe that the rate of consolidation of practices will increase and there will be winners and losers, with larger groups increasing their percentage share of the market. The space allocated to general practitioners within our buildings is restricted unless they are a strong group holding long leases, or have demonstrated that they have successfully embraced telemedicine."

* This is a contributed article and this content does not necessarily represent the views of techtimes.com