The crypto market has ballooned into a trillion-dollar ecosystem, making it one of the fastest rising industries within the past decade. This new area of innovation has created opportunities for tech-savvy developers and market analysts, including Wall Street veterans.

With the crypto market coming of age, stakeholders have introduced sophisticated market instruments such as derivatives. These financial instruments have gained popularity in the crypto space within the past few years and are now a significant part of the crypto market price movements.

Some of the commonly traded derivative instruments in the crypto market include futures, perpetual and option contracts. The latter type of derivative instruments expire monthly, an event that crypto market analysts believe affects the market prices. Some of the Bitcoin price predictions for December 2021 are based on the existing option contracts.

Crypto Market Option Contracts

Similar to the options offered in traditional financial markets, crypto options are structured based on the expiry date, strike price and quantity. In most cases, the larger part of traded options expires every month, usually on the last Friday of the month.

As for their effect in the crypto market, some analysts argue that crypto market prices are more volatile in the last week leading up to the options expiry. This can be seen in recent months options expiry where the price of BTC has been fluctuating towards the 'max pain' price. Max pain is the price at which option sellers get to make the most profits; given that option buyers will lose their premiums on settlement.

For instance, Bitcoin's price plunged from $60,000 to $50,000 in the last week of March, reducing the gap between spot prices and the max pain point, which was $40,000 at the time. Meanwhile, April options saw bull regain control of the market as the price bounced to $54,000 to hit the max pain point ahead of the expiry.

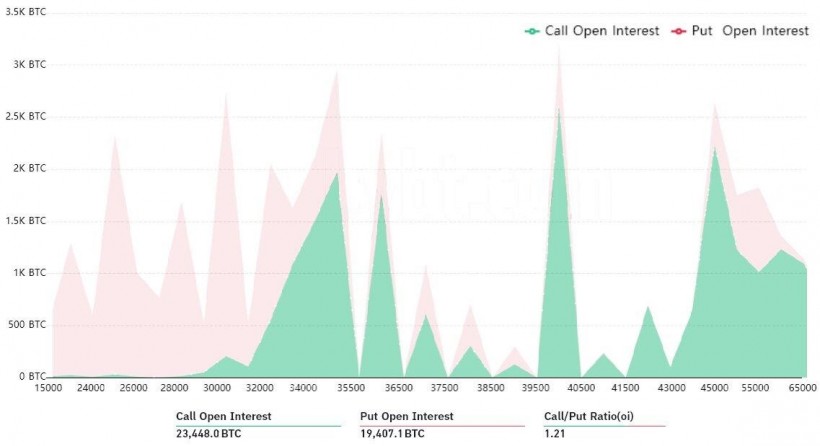

Image Source: Cointelegraph

With the latest options expiry set for July 30, analysts expect that bulls will try to maintain the price above $40,000. The total number of Bitcoin option contracts set for settlement is 42,850, roughly $1.7 billion worth of BTC option contracts per prevailing market prices. This expiry will likely mark the first time bulls have regained control since the May bloodbath.

Most of these option contracts are currently traded on centralized exchanges such as Deribit, Binance and BitMEX. However, the narrative is gradually changing with the invention of Decentralized Finance (DeFi), an upcoming crypto niche that features decentralized financial market products with the latest innovations focusing on building decentralized derivative instruments.

Decentralized Crypto Options

The DeFi market is still a developing niche, but innovations are happening at lightning speed. Initially, most of the DeFi products were focused on decentralized exchanges and lending & borrowing platforms. The market is now seeing a new wave of decentralized products, including sophisticated instruments such as crypto derivatives.

Some DeFi platforms like Premia Finance have gone to the extent of featuring customizable call and put options. This decentralized financial instruments protocol supports covered call and put options for several Ethereum native tokens and Binance Smart Chain (BSC). Essentially, Premia allows crypto users to mint/create customizable options to be sold directly in the market or stored in a user's wallet.

With Premia's customizable options, crypto market traders and investors can create hedged portfolios through native tokens. The protocol enables users to customize features such as the expiry date, strike price and quantity. Furthermore, Premia users can stake the platform's native token to earn a share of the transaction fees.

Notably, there are other decentralized derivative protocols, although most leverage the ERC-20 or ERC-721 standard, limiting the deployment of customizable options. Premia uses the ERC-1155 standard, allowing the protocol to offer p2p options, asset selection, complete customization, composability and secondary market support.

The Value Proposition of Derivative Instruments in Crypto

Derivative instruments are some of the most traded financial instruments in traditional finance, with an estimated $1 quadrillion on the higher side. In the crypto market, it is estimated that the 'average daily traded crypto derivatives market supersedes the regular spot market by a factor of five.

So, what is the fundamental value proposition of crypto derivatives? For starters, these financial instruments boost the crypto market liquidity by attracting more capital. In addition, crypto derivatives create an opportunity for stakeholders to diversify their portfolios or hedge positions through delta-neutral strategies.

That said, it is noteworthy that this class of crypto-asset carries a significantly higher risk. Crypto traders who trade derivatives are massively exposed to the volatility that comes along with this market. It is no surprise that popular crypto exchanges, including Binance and FTX, recently reduced their leverage limits.

Conclusion

Crypto market options have changed the landscape a great deal. Going by the current adoption trends, it is likely that settlement dates will significantly influence the crypto market growth. Even better, the introduction of decentralized derivatives is set to open up more opportunities for anyone to trade these sophisticated instruments. This is one of the crypto market trends to watch in 2021!

* This is a contributed article and this content does not necessarily represent the views of techtimes.com