Crypto loans have continued to gain popularity in the crypto space following the recent crypto advancements into DeFi, staking, yield farming, and other forms of crypto investments. As such, a crypto loan could be a profitable tool for earning money. As a result of widespread crypto loans, crypto companies have provided cryptocurrency enthusiasts with faster and more reliable crypto financing.

However, due to the recent loss of capital on fraudulent crypto loan platforms, crypto users must perform deep research to vet and interact with only credible platforms before relying on some cryptocurrency loan platform. Some cryptocurrency loan platforms offer significantly higher interest rates that have repeatedly exposed their users to undesired high risks. The following points have to be considered for the crypto lending platforms:

-

Partnerships: Famous companies as partners are a sign of trust to be considered.

-

Business model: Platforms that do not invest collaterals into third-party projects significantly reduce the risk. Crypto loan platforms that thrive on a straightforward transparent business model that profits from standard market rates are preferred.

-

Service: The details to be provided as KYC, credit scores etc. Recommended platforms only require emails and phone numbers to disburse loans to your wallet.

After identifying a trustworthy crypto loan platform, there comes the importance of spending the crypto loan with the maximum profit. Below are proven ways to earn money with a crypto loan.

1. Diversify portfolio

Holding a diversified cryptocurrency portfolio is a proven way to hedge for crypto volatility, that's why the crypto loan could be profitably invested into the promising digital assets that aren't present in a portfolio yet. The crypto loan provides the possibility to diversify the portfolio by keeping assets in a platform, as a collateral, which belongs to the investor and purchasing the new promising coins with the loan to add into the digital portfolio.

The crypto market is aggressive and operates 24 hours daily. These characteristics make it highly volatile compared to traditional financial markets like the Stock market, for this sake it is smart to keep the assets mightily diversified.

Investors often prefer to hold a carefully chosen set of tokens to help manage their losses whenever the market turns red. A crypto portfolio with a combination of good tokens would provide a hedge against market volatility. Some cryptocurrencies backed by analysts are

-

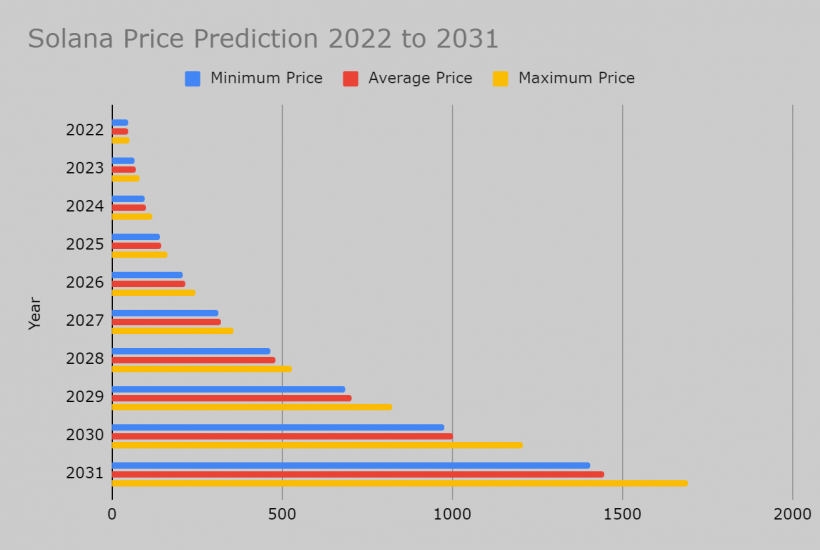

Solana.

-

Chainlink.

-

Decentraland.

2. Buy and hold

Ideally, borrowing against crypto allows retaining custody of crypto while also gaining the benefits of using the crypto loan amount to buy and hold long-term bullish coins with maximum potential profit. It is possible to take a crypto loan and use the loan amount to purchase any trending coin. When the trending coin's price increases, reap the profits and sell at the right time.

The profits from sold assets can be used to repay the loan amount and get back your collateral, giving an extra earning opportunity to crypto-backed loan users.

Best crypto loans are allowed to hold tokens for as long as needed since some platforms offer unlimited loan terms. With unlimited loan terms, it is possible to hold and sell tokens at the right time, whenever it is a time to maximize profits.

3. Day trading

Day traders can significantly increase earning potential while simultaneously reducing risk exposure using crypto backed loans. The advantage of trading with the crypto loans is in receiving low-interest rates while maintaining intact crypto portfolios by taking out a crypto loan.

Day traders can make significant profits that aren't often possible for long-term traders on a day-to-day basis. Experienced traders use crypto financing to earn more money without selling their or their clients' long-term cryptocurrency portfolios.

Day traders are often in need of short term loans that can be used to make daily profits off the crypto market. The Cryptocurrency loan allows day traders to take short term instant loans that can be terminated after closing the day's trading session with profits.

4. Purchasing real estate

Crypto loans have unlimited use cases. Crypto loan platforms often allow borrowing against crypto with flexible terms and conditions. Investors can select from various acceptable collaterals and take out crypto loans as stablecoins. The stablecoins can be used to purchase real estate investments that are perceived to have a higher return on investment (ROI) in the long term.

Also, using crypto to purchase real estate investments could exempt you from paying taxes. There are countries with tax free crypto regulation. These countries do not tax cryptocurrency purchases like Bitcoin and treat the purchase of taxable goods with cryptocurrencies like taxable transactions.

Profits earned from real estate investments could cover with excess the payback of the loan amount plus interest to receive initial collateral.

How to get the loan

So how do you get a loan from the platform that successfully passed the points to be considered for the trustworthy crypto platform? Below is a step-by-step guide to getting a crypto loan from the strongly credible crypto lending platform CoinRabbit in 15 minutes:

-

Calculate - Calculate the amount of loan you need from the Loan Calculator.

-

Get in 15 minutes - Apply for the Loan by depositing your collateral. Loans are typically disbursed on your digital wallet in 15 minutes.

-

Spend - Spend received loan on promising assets.

Conclusion

Crypto loans have opened the digital financial market to a new world of possibilities. Earning passively using crypto loans has never been easier: investing and trading are accessible from one click, sitting on the sofa, or lying on the beach coach. Crypto lending platforms have simplified the crypto loan process that can be used to earn money, using the methods discussed above. Taking deep market research and fast reacting to market changes can build a solid safety cushion and a profitable digital portfolio.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com