Secure and seamless identity verification has become essential to security online and customer trust. As organizations across sectors, from financial services to travel and healthcare, accelerate their digital transformation, the demand for robust identity verification solutions has grown exponentially.

We identified five leading platforms that are setting the benchmark for excellence in Identity Verification. These industry pioneers are leveraging advanced technologies to enhance compliance, streamline user onboarding, and fortify digital interactions—positioning themselves as indispensable partners in a security-first world.

Identity Fraud at an All-Time High: UK and US Overview

In the United Kingdom, cases of identity fraud within financial services have been on the rise. Insightful research carried out by Synectics in March 2024 found that 45% of bank-reported fraud in the UK consisted of identity fraud. Similarly, Cifas, the UK's largest cross-sector fraud sharing database, found that identity fraud now costs the UK an estimated £1.8 billion each year.

This cost brings widespread repercussions to the UK economy in both the short and long term, including:

- Increased costs of reimbursements for victims of identity fraud.

- Damage to consumer confidence in digital services.

- Strained public resources, such as law enforcement and the judiciary.

- Increased insurance premiums and a requirement for more stringent regulatory frameworks are putting a greater compliance burden on businesses.

The UK government is already taking measures to ensure that businesses are held accountable for some of the fraud cases that take place on their platforms, specifically Authorised Push Payment (APP) fraud, with a maximum reimbursement of

£85,000. This further pushed the burden of financial scams onto the shoulders of the financial services sector, meaning that now more than ever, banks must implement stringent KYC processes if they like to avoid such hefty reimbursements. The maximum reimbursement level is expected to be reviewed again in Q4 2025, alongside the UK Governmentʼs release of an expanded fraud strategy and the Failure to Prevent Fraud Offence, which goes into force in September 2025.

Much like the UK, the US paid a steep price for KYC and AML failings in 2024, a costly $47 billion. US regulators were also quick to hand out severe financial penalties, with TD Bank having recently paid a fine in the billions for AML violations.

Other notable cases included City National Bank, SkyCity Adelaide Pty Ltd, Klarna Bank AB, and Starling Bank.

The Cost of KYC

Implementing a KYC platform might initially seem like a painful process to go through, but with the right provider, it can happen seamlessly, making your compliance efforts easier and ensuring you avoid the steep cost of avoiding KYC/AML checks or running them manually. The Business Reporter underlined in a recent article the potential losses involved with skipping KYC, highlighting that AML compliance can cost banks up to €50 million annually. "The potential cost of losing even a small percentage of new customers due to complicated manual KYC processes can reach up to €10 million per year." In addition, this doesnʼt even account for any regulatory fines that businesses may face, which, as weʼve seen with TD Bank, can even reach multi-billion dollar figures.

As a result, choosing the right KYC platform is critical, as highly advanced technologies are now needed to spot modern-day fraud, which can be highly deceptive. Biometric data must be pulled and analyzed, with robust liveness detection leveraged to identify deepfakes. A sophisticated identity verification platform will be able to analyze subtle facial micro-expressions, skin textures, and the intricate mappings of a presented face with almost flawless accuracy, ensuring true authenticity. Yet, these checks must still be frictionless to avoid high drop-off rates.

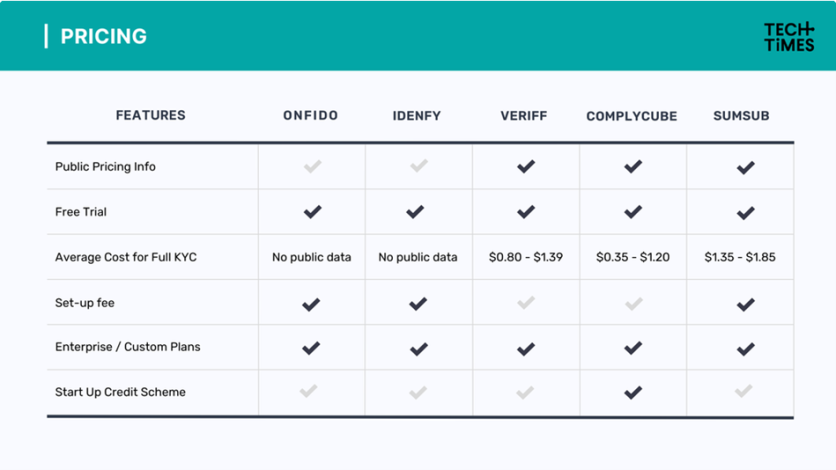

Transparent pricing is also critical, as some providers will include hidden fees by excluding necessary functions or services, such as report downloads or ongoing monitoring, from their standard packages. Many providers also come with high set-up and onboarding fees, which can erode your ROI on the implementation of the chosen provider, whilst others waive this entirely.

The right KYC provider can be an excellent way for any business to streamline operations securely, leveraging advanced technology to keep both their customers and their reputation safe. Yet, choosing the wrong KYC solution can leave businesses vulnerable to the facilitation of money laundering, substantial fines, and fraud threats.

The Five Best IDV, KYC, and AML Platforms For 2025

These providers have been selected based on a wide range of criteria, including technological advancement, pricing transparency, value for money, quality of checks, customers onboarded, global coverage, and more.

#1 Comply Cube

Overview

- Offers an all-in-one AML, IDV, and KYC suite of solutions, providing the widest possible range of checks.

- The average price per KYC check within the basic plan ranges from around $0.35 to $1.20.

- The best coverage, pricing flexibility, and customer satisfaction within the market.

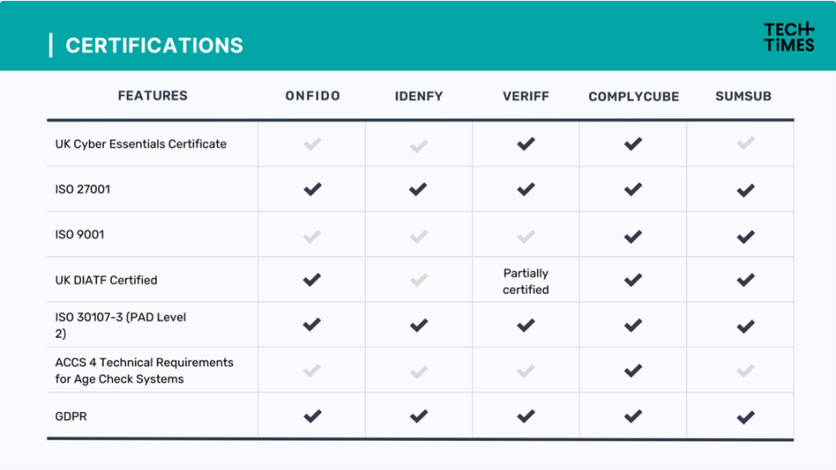

- One of the most certified providers amongst competitors, with ISO 27001, ISO 9001, UK Cyber Essentials, fully certified under the UK Governmentʼs DIATF framework, ISO 30107-3 (PAD Level 2), and more.

- Highly transparent pricing models with no set-up fees or unnecessary add-ons.

- Supports over 250 countries and territories globally.

- G2 leaders boasting a 5-star rating.

ComplyCube, headquartered in London, United Kingdom, has developed an innovative, all-in-one compliance platform that integrates Identity Verification (IDV), Know Your Customer (KYC), and Anti-Money Laundering (AML) compliance into a single, easy-to-use solution. Their unique, explainable AI models prioritize transparency by delivering granular, actionable insights, moving away from traditional 'black box'AI, and aligning with global compliance standards such as FATF, FinCEN, ICO guidance, GDPR, the UK DIATF, and eIDAS.

Recognized by industry leaders in the banking sector, ComplyCube has secured the RegTech Partner of the Year title at the prestigious British Bank Awards twice in a row, in 2024 and 2025. Additionally, the ISO-certified platform claims to offer the fastest omnichannel integration turnaround in the market, featuring low/no-code solutions, APIs, mobile SDKs, client libraries, and CRM integrations.

ComplyCube has developed an improved approach to identity verification by correlating visual and behavioral vectors to create an ensemble of user identification classifiers. These classifiers leverage advanced deepfake detection techniques, resilient to evolving threats, ensuring the system is robust against new data and tampering attempts.

The company's R&D efforts focus on integrating deepfake detection, behavioral biometrics, and model interpretability to deliver a more reliable and resilient solution. By correlating visual and behavioral data, ComplyCube has developed a unique approach to identity verification that is resistant to evolving threats, including deepfake and pixel tampering. Their platform also incorporates movement-oriented biometrics for enhanced authentication. ComplyCube stands out for having the most transparent pricing on the market.

#2 SumSub

Overview

- An end-to-end customer verification and transaction monitoring solution with a strong presence in high-risk sectors such as Gaming and Crypto.

- The average price per check is a little higher, ranging from around $1.35 in their basic plan to $1.85 in their compliance tier pricing plan.

- Comprehensive coverage, but lacking AML Risk profiling or age estimation.

- Some additional fees include an initial set-up fee and a KYB data access fee.

- Supports over 220 countries and territories globally.

- Awarded 4.6 out of 5 stars on G2.

SumSub, headquartered in Limassol, Cyprus, offers a range of services to help businesses improve their compliance procedures. The platform offers solutions that are able to minimize risk and help businesses meet strict compliance requirements. With a user-friendly interface and advanced software such as liveness detection, facial verification, and document checks, SumSub offers businesses a substantial range of solutions.

The platform employs machine learning and AI software to identify potential security vulnerabilities and abnormalities.

As far as usability is concerned, SumSub has created a visually appealing, intuitive UI. However, it relies on a number of underlying partners for delivery of the full suite of services. SumSub works with a number of partners to deliver such a wide breadth of services, including Crystal, Chainalysis, and Elliptic for Wallet AML Screening & Risk Scoring and Volt.io for Penny Drop Verification, amongst others.

#3 Onfido [Entrust]

Overview

- Offers a narrower set of products than SumSub or ComplyCube, with a focus on identity verification for individuals.

- Lack of visibility around pricing online.

- Cannot offer age estimation and KYB.

- Highly certified, though missing ISO 9001 for Quality Management.

- Supports over 195 countries and territories globally.

- Achieved 4.4 out of 5 stars on G2.

Onfido, headquartered in London, United Kingdom, is an identity verification platform that uses AI and machine learning to confirm user identities in online environments. It offers features such as liveness detection, document scanning, AML screening, AAMVA verification, and database checks. The platform is designed to help businesses improve security and streamline customer onboarding. Its algorithms analyze documents and user data to detect potential fraud, though, like any automated system, accuracy can vary.

Onfido does provide global coverage, supporting over 195 countries and territories. However, this is well below the high benchmark set by competitors, with ComplyCube supporting over 250, Veriff over 230, and SumSub over 220.

Onfido provides API integration and customizable workflows to accommodate different business needs. They also offer Driver Registration using AAMVA checks in the US; however, arenʼt connected to the DVLAʼs Access to Driver Data (ADD) service in the UK for infringements and licence validity (one provider that does have access to the DVLA is ComplyCube).

#4 iDenfy

Overview

- Hybrid solutions combining AI and human expertise.

- Lack of visibility around pricing online.

- Supports over 200 countries and territories globally.

- Lacks a firm stance within the UK market due to limited services and certifications.

- Provides flows that are easy to engineer, with an intuitive platform and great user experience.

- Achieved 4.9 out of 5 stars on G2.

iDenfy, established in 2017 and headquartered in Kaunas, Lithuania, is a company specializing in identity verification, fraud prevention, and compliance solutions. Their platform assists businesses in adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations by transforming customers' smartphones or computers into identity scanning terminals equipped with facial recognition capabilities.

iDenfy offers a wide range of solutions and checks, combining AI and human input. Whilst a newer platform, iDenfy has established itself firmly within the IDV space. The company offers an intuitive interface with simple, no-code flows that can be easily engineered.

However, they lack leverage within the UK market due to their lack of certifications, such as the UK DIATF certification, and lack of access to fraud database checks in the UK.

#5 Veriff

Overview

- Supports over 230 countries and territories globally.

- Average cost per check ranges between $0.80 in their essential plan, $1.39 for their plus tier, and $1.89 for their premium tier.

- Transparent pricing with no set-up fees.

- Does not provide KYB offering.

- Achieved 4.4 out of 5 stars on G2.

Veriff, headquartered in Tallinn, Estonia, is an identity verification company based in Estonia, providing a robust solution for online businesses. It helps organizations build trust, strengthen fraud prevention efforts, and ensure compliance with regulatory standards. Veriff is a well-known identity verification service provider that has been established within the market for over 10 years. Supporting over 230 countries and territories globally, Veriffʼs coverage is notable across the world.

Best Overall: ComplyCube

With a high number of certifications, the widest array of solutions, and transparent pricing, ComplyCube is a market leader within the Identity Verification space. Their platform truly offers a one-stop shop for all things KYC and AML, boasting a 5-star G2 rating and hundreds of happy clients.

ComplyCube serves most countries and territories globally and offers the most transparent pricing models. While many providers charge hidden fees, including a set-up fee, ongoing support fees, or even fees for data downloads, ComplyCube explicitly calls out which features and functionality are included in each of its packages, including Enterprise, within its standard packages.

For more information on ComplyCube, get in touch with a member of their expert compliance team.

ⓒ 2025 TECHTIMES.com All rights reserved. Do not reproduce without permission.