Communion is on a mission to help people build a financial buffer against the world and fix their relationship with money. Through mindset, skills and knowledge, unlike any other finance platform, Communion tackles underlying and pervasive money anxiety. Members are coached through a personalised wealth-building plan and explore their own unique relationship with money with the help of the community and unlimited access to its team of Money Guides.

The launch comes at a time of great financial uncertainty, fuelled by rising interest rates, cost of living hikes and pay freezes. Communion's own research has found that 94% of 18-40 year olds have suffered from money anxiety and, for one in four of them, not a day goes by without worrying about money. Half of those surveyed believe they will never have enough money.

READ ALSO: Top 5 Best FinTech Conferences of 2022: An Events Guide

Watch the F.U.nd Film here: https://vimeo.com/855143195?share=copy

From a cost-of-living crisis to corrupt politics, there's never been a more important time to change the narrative on savings. To tackle this head on, the app is launching with a F.U.nd - which stands for 'fuck you fund' - a term inspired by writer Paulette Perhach. Users can build their very own physically 'fuck off fund' to save money to get financial freedom.

By building financial autonomy with the app, users can say 'fuck you' to the predatory landlords or sadist bosses that are making them worse off than they want to be.

The brand will be giving away a physical representation of the FU fund to its first users in the form of a chrome middle-fingered money bank.

With Communion, you get:

-

Mindset, skills, knowledge: unlike any other finance platform, Communion uses psychology and behavioural science to tackle underlying and pervasive money anxiety. Members are coached through a personalised 12-step wealth-building plan and explore their own unique relationship with money with the help of Communion's community and unlimited access to its team of Money Guides.

-

Up to 5.66% on savings: members earn 3.66% AER in an FSCS-protected easy-access savings account from day one. Unlike any other savings account, Communion has integrated a unique top-up bonus feature which allows each member to earn up to an additional 2% on their standard rate of 3.66% AER by inviting friends to join them in the app. Friends who sign-up and remain members of Communion also benefit from a 0.2% bonus and can, in turn, boost their standard rate by inviting their friends, and so on. Returns of up to 5.66% make Communion's savings account one of the most competitive on the market today.

-

Financial autonomy: members build an 'F.U.nd', giving them ultimate control and confidence to say "eff you" to anyone or anything that's holding them back. Communion's unique autosave technology allows savers to incrementally reach their personalised saving target over time.

Founder and CEO of Communion, Daniel Hegarty, says: "We believe everyone has the ability to take control of their money and build a buffer against the world, so long as they're given the right conditions, tools and support to do so. We created Communion for people who want to live life with more autonomy and less fear.

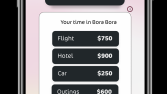

You want to go on holiday. You want to move to a nicer area. You want to quit your day job. You just want to feel less anxious about money. The difference between doing the thing you've always wanted to do, and never having the chance isn't hustling, get-rich-quick-schemes or meme stocks - it's saving. But as simple as that sounds, saving is a really hard thing to do. Pretty much everything around us prevents us from being able to hold on to what we earn and no one is currently tackling the underlying pressures and biases that are at play when it comes to money."

To date, Communion has raised £2.5m in pre-seed funding from VC firm Target Global and a number of investors including Max Rofagha, Greg Marsh, Erin Lantz and Uncommon Creative Studio - who are also creative partners.

RELATED ARTICLE: New Social Fintech App Foresyte Brings Clarity to the Fun Parts of Life