China has recently taken a major move toward asserting its dominance over the global rare earth supply chain by imposing a sweeping ban on importing critical rare earth technologies.

The move, announced by the Ministry of Commerce, includes restrictions on technologies critical for extracting, separating, and refining these strategic metals, indicating a strategic maneuver to preserve its industry dominance (via Bloomberg).

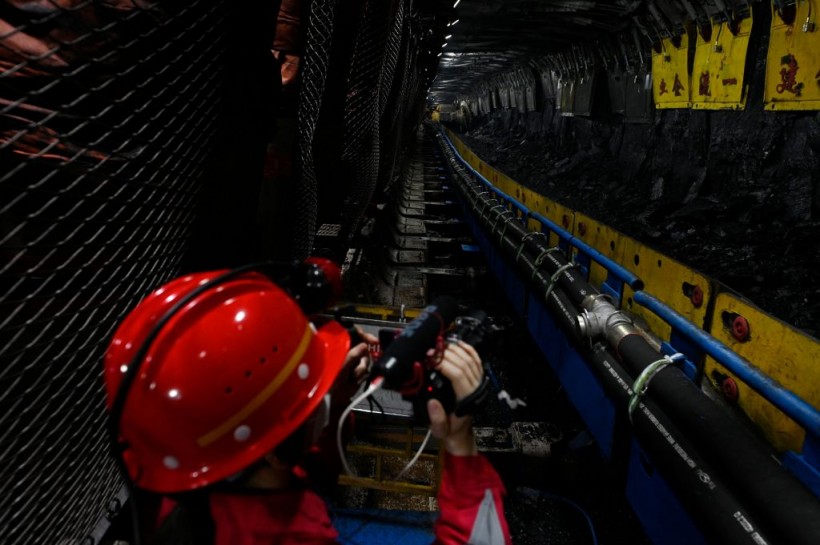

A shearer machine (back) is seen underground in the Xiaobaodang coal mine during a media tour of the Shaanxi coal mines organized by Chinese telecoms giant Huawei near Yulin, in China's northern Shaanxi province on April 26, 2023. (Photo by WANG Zhao / AFP)

China's Dominance in the Rare Earth Metal Market

China's historical dominance, accounting for over two-thirds of mined rare earth and a staggering 85% of global refining capacity, has placed it at the epicentre of this vital supply chain. According to Statista, China's mines produced almost 210,000 metric tons of rare earths in 2022 alone.

Rare earth metals, a cluster of 17 elements, are integral in an array of high-tech industries, ranging from electric vehicles to military hardware and electronics.

As a result, China has become the world's largest supplier of rare earths. It has established a global monopoly by integrating the entire process, from mining to refining.

The significance of this ban lies in its potential to reshape the dynamics of rare earth trade on a global scale. While the West, including the US, Japan, and Europe, has been striving to decrease dependency on Chinese rare earths, this latest move by China stands as a formidable challenge to those efforts.

Read Also: Japan Invests Millions in Australian Deal for Rare Earth Metals, To Cut Chinese Reliance

Sending Shockwaves on the Global Supply

The ban focuses on "heavy rare earths," where China has an unrivaled monopoly on refining. Heavy rare earths, such as dysprosium, required for permanent magnet motors in electric vehicles, are central to the high-tech manufacturing landscape.

Reuters tells us that China's advanced technology and cost-effectiveness in separating these rare earths pose a significant challenge to establishing comparable capacities outside its borders.

While the West has made strides in setting up processing facilities for "light" rare earths like neodymium and praseodymium, the complexities of deploying China's solvent extraction process have posed substantial hurdles.

As a result, the global supply chain remains heavily reliant on China, particularly for heavy rare earths critical for cutting-edge technologies.

This latest move underscores a broader geopolitical tussle between China and Western nations for control over critical minerals. The US, in particular, has spearheaded initiatives to reduce reliance on Chinese rare earths.

President Joe Biden's climate legislation includes provisions intended to bolster domestic or allied nation supply chains, reflecting growing concerns over vulnerabilities tied to foreign dependencies.

China's export ban aligns with its previous restrictions on key materials like gallium, germanium, and graphite, amplifying the narrative of a concerted effort to counter Western initiatives in securing independent supplies.

The timing of this move amplifies the geopolitical tensions as the world grapples with supply chain disruptions and increased competition for strategic resources.

However, experts caution that while the ban restricts the export of technology, the actual extent of its implementation remains unclear. China has been discouraging rare earth exports since 2007, leveraging its technological advantage as a deterrent.

Stay posted here at Tech Times.

Related Article: Mitsubishi Materials To Start EV Battery Recycling with New Rare-Earth Metal Extraction Technology