In 2010, Bitcoin mining was a hobby especially by gamers who would earn 50 BTC in 10 minutes. Fast forward to 2021 and it's a whole new ball game. Bitcoin mining has moved from a pastime activity in the confines of a bedroom to a multi-billion dollar industry attracting corporate giants and heavyweight investors.

With the entry of commercial players into the crypto mining business and the ever-changing prices of Bitcoin, a lot has changed in the industry. Following the Bitcoin halving event in May 2020, the block reward reduced to 6.25. All these factors beg the question, is Bitcoin mining profitable in 2021?

To better answer this question, let's dig deeper into the mining process and look at the forces that dictate the profitability of the venture;

What is Hash Rate?

In simple terms, hash rate is a measure of a miner's computational power. Mining is the backbone of all proof-of-work blockchains, where miners participate by adding and verifying transactions on the blockchain ledger and conduct proof-of-work computations in return for Bitcoin rewards.

The miner who completes a calculation ahead of everyone else adds a block to the blockchain and earns a Bitcoin reward. It is a computational arms race where those with the most hash rate or computing power stand the chance to mine more Bitcoin.

The process is repeated every 10 minutes for every mining machine connected to the network with the computations becoming harder as more miners/machines/computing power is added to the network.

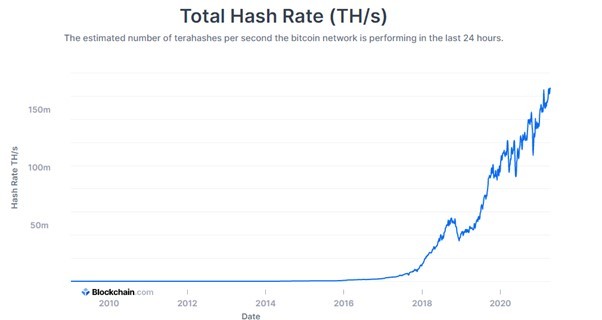

Initially, hash rate was measured in hash per second but the exponential growth in mining has seen measurements move to giga hash per second. All this is tied up to the amount of energy used to power the mining machine. One giga hash per second is powered by one watt.

Bitcoin Mining Revenue

Currently, one Application Specific Integrated Circuit (ASIC) chip generates around $8 in Bitcoin rewards every day. This revenue is twice higher than what is earned when the same amount of energy is used to mine another cryptocurrency. While this makes Bitcoin a better choice to mine than other coins, its profitability is still pegged on its market price.

Other than Bitcoin block rewards, the fees charged on Bitcoin rewards is a second source of revenue for miners. Whether users are moving Bitcoin into their altcoin wallets or in an exchange, every transaction is recorded on the blockchain. Since these records are unchangeable, miners always receive their fair share of the fees.

Increasing mining Difficulty

Compared to the industry's infant days where miners used their personal computers in their bedrooms, miners of 2021 include corporations with sophisticated mining networks and equipment with tremendous computing power.

Simply put, computations have become complicated to solve making mining difficult. With millions of mining machines on the network, it has become a battle of mining companies with systems that have the highest computing power/hashrate.

Under what circumstances is Bitcoin mining profitable?

The increase in power consumption, difficulty in mining, and the expensive cost of current mining machines are some of the factors that make Bitcoin mining a less profitable venture than it was in the early days. To make a profit, these three factors have to balance:

Cheap electricity

The cost of power varies from one country to another and depends on specific countries' supply and policy with regard to crypto mining activities. In some countries, power is meant for industrial activities to spur economic growth.

Countries like Russia and Saudi Arabia enjoy low power costs compared to countries like Germany and Italy. The incentives to mine Bitcoin may therefore vary from one country to another due to differences in the cost of energy.

Efficient Hardware

As earlier noted, the mining business has become competitive and currently operates at the level of mining networks and data centers with hundreds of powerful mining machines.

With this kind of sophistication, mining is only profitable with powerful and highly efficient mining devices or systems. You need a fast system that can complete calculations ahead of all other computers on the network.

There are several machines on the market, some configured to mine specific altcoins. Factors to consider include the cost of the machine, speed, and efficiency in terms of energy consumption.

Stable Mining Pool

Currently, to make a profit from crypto mining, one needs to join a mining pool. With so many machines looking to solve puzzles, one's chance of finding a block is slim or near impossible. However, when in a mining pool, miners can enjoy constant and reliable profitability.

Parting Shot

To this end, it is safe to conclude Bitcoin mining has become a sophisticated and expensive affair. An average home miner may not be able to recover the cost of mining especially the electricity and the mining hardware. To make something out of Bitcoin mining, one needs to join a mining pool to benefit from economies of scale.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com