Getting started in DeFi can be challenging - complex terminology, lack of cohesive definitions and rapidly changing technology can present hurdles to newcomers. Yield Optimization, for example, is a method for maximizing income through different farming and staking methods.

Traditional Yield Optimizers lack flexibility, customization and can be confusing to understand when getting started. Users stake an LP and automatically gain more of the same LP, increasing LP token holdings regardless of dollar value. This closed loop scenario fails to encompass essential components of savvy investing like taking profits or portfolio diversification.

Bloomify revolutionizes the field by providing users access to clear-to-understand staking options that allow them to diversify, take profit, accumulate without adding fresh funds, and more.

Let's find out more about Bloomify.

What does Bloomify provide?

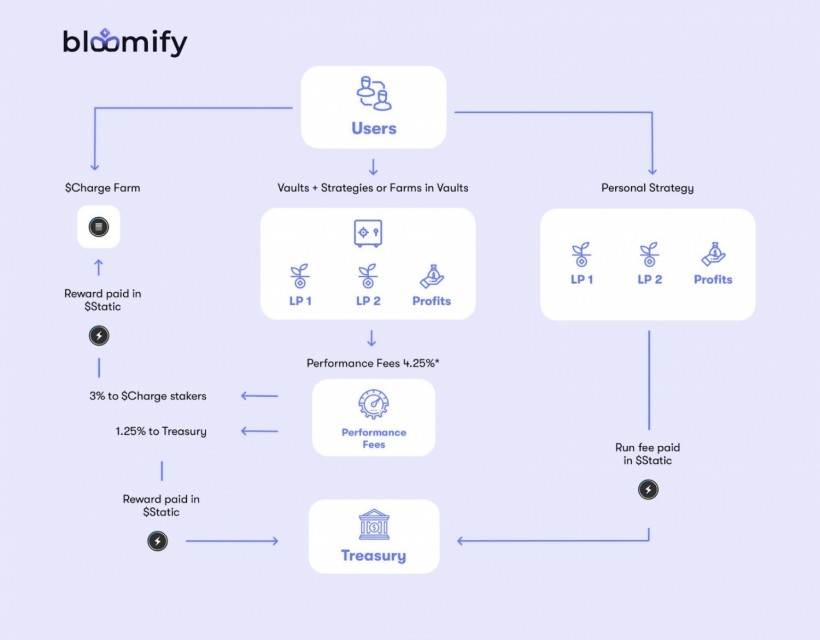

Bloomify is the future of Yield Optimizers - users can automate their custom portfolio with Accumulators, Profit-Takers, conventional Vaults, Farms, and Advanced Strategies.

Automating your investments gives you more opportunities to reach your financial goals faster. So now, you can take control of your investments by allocating to different easy-to-use staking options while saving time through Bloomify's automation.

With Bloomify's Advanced Strategies, you can semi-customize your staking to loop through multiple LPs and take profit back to your wallet. Note, all Advanced Strategies have at least one component that will need to be manually run when profit exceeds the cost of running.

Bloomify's Accumulators allow you to use profit earned to accumulate another token. Deposit LP1, yield generated buys LP2, and LP2 autocompounds in the Bank to buy more LP2. Accumulators are fully automated to share gas costs and they generate performance fees for $Charge stakers.

Bloomify's Profit-Takers encourage you to take profit - something that is oftentimes missed much to the detriment of the investor. Deposit LP1, yield generated buys a stablecoin LP2, and LP2 autocompounds in the Bank to buy more LP2. Profit-Takers are fully automated to share gas costs and they generate performance fees for $Charge stakers.

Conventional Vaults operate in Bloomify the same as most standard vaults - deposit LP and the yield is sold to buy more of the same LP increasing your LP token quantity.

Bloomify farms allow users to stake one token or LP and earn another. Note there is no compounding feature; all yields must be managed manually. There is no run strategy either, the farm continues to yield as long as you are staked and yield is generated.

More about Bloomify

Bloomify is a necessary alternative to traditional Yield Optimizers and their inflexible, closed loop staking systems. The autocompound-only method of other optimizers can be harmful to both the investor and the protocols they are investing in. One size fits all approaches should not apply to a variety of investors, Bloomify rectifies these issues.

Platform users can build multi-layered strategies, minimize risk while still investing in new projects, produce profits, promote diversification, and enhance flexibility.

Bloomify also comes with two native tokens - $Charge and $Static, that help enhance users' profit opportunities.

$Charge is a platform token that can be held and staked to earn a portion of Performance Fees paid out in $Static.

$Static is the reward token of Bloomify, in which the user receives a portion of Performance Fees but can also use it to pay discounted Run Fees on Advanced Strategies.

By staking Bloomify's token, $Charge, users get the chance to take a share of the Performance Fee rewards and profit from their platform's growth. And as TVL increases, rewards increase back to $Charge stakers!

Website: Bloomify

Social Channels:

* This is a contributed article and this content does not necessarily represent the views of techtimes.com