With the cryptocurrency investment market facing fundamental changes, one ambitious financial platform is aiming to democratize digital currencies by making it accessible to investors of all backgrounds and producing strong yields, ending Wall Street's domination of the sector.

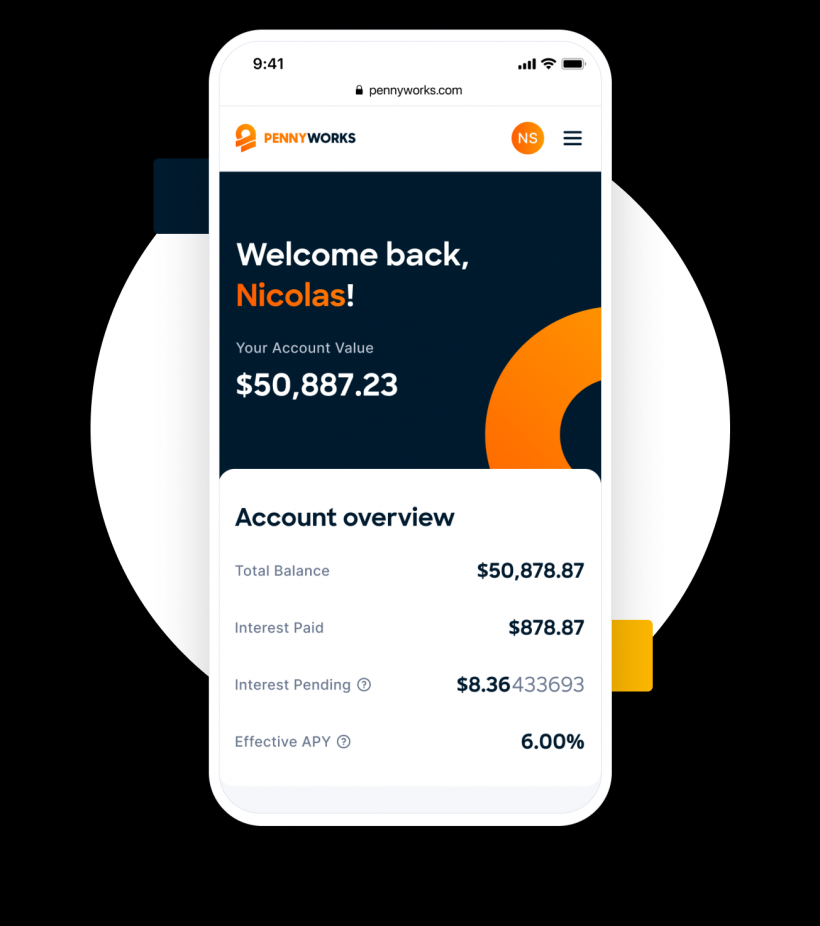

PennyWorks, based in Hoboken, New Jersey, offers its clients a streamlined and stable crypto investment platform that can withstand wild economic fluctuations. CEO Ivan Zhang, who has roughly a decade of top-level experience with digital currencies and portfolio management, has the goal of using PennyWorks to decentralize investments and give people more control over their money.

The company's service offers high rewards and low risk, with a process that starts by converting an investor's U.S. dollars into stablecoins pegged to the dollar in order to avoid market volatility. Next, the company lends those stablecoins via collateralized loans, generating impressive yields at low levels of risk, with earnings based on the size and duration of an investment.

It's part of a broader push known as Web3, which envisions a user-owned internet where third parties no longer control everything. Instead, it advocates a decentralized finance (DeFi) model where individuals can have the same access to crypto deals that Wall Street has long enjoyed.

"Our seasoned fixed-income and digital asset investment team draw on the experience of working with the largest banks on portfolio management and quantitative modeling. We can effectively and securely reduce the risk of digital asset lending and create stable yields," according to a fact sheet available on PennyWorks' website. "We take a risk-based approach to lending and carefully vet out lending opportunities across blockchains, lending protocols, and stablecoins. We take into account their technical maturity, liquidity, and design features. We also use our scale to reduce the transaction costs of rebalancing investment opportunities."

On its website, the company also offers a free, regular series of articles explaining all anyone needs to know about investing in crypto, DeFi, stablecoins, and more. It's part of what Zhang describes as a broad, determined effort to make digital asset investing more democratic.

Zhang, who started as a crypto trader in 2013 and founded PennyWorks in April 2021, says, "We provide a familiar traditional finance way for investors to interact with the blockchain so that they can get the best out of the DeFi revolution without all of the headaches."

The advice included in PennyWorks' ongoing series of articles can be invaluable both for its ever-expanding list of clients and also for casual readers interested in cryptocurrencies.

Both the company's service and the free articles come at an opportune time, as the world of digital assets faces dramatic changes. Recent months saw a number of cryptocurrencies suffer dramatic slumps or total collapse, costing some investors a significant amount of money. And the digital currency Ethereum this month will shift to a much less energy-intensive process, which observers say could further shake up the market for investors of all sizes.

Zhang says that PennyWorks' system is designed to ensure consistent growth and positive yields on investments, and is able to withstand any one-off major upticks or drops.

"The recent meltdown of some crypto lenders makes people scared since they lump all currencies together and think they're all unstable and risky," says Zhang. "Our approach is one of the safest form of lending possible, and it weathered the recent meltdowns unscathed."

* This is a contributed article and this content does not necessarily represent the views of techtimes.com