Roughly 1.7 billion people around the world don't have a bank account. That's in large part because financial institutions exclude many people from their banking systems, forcing them to rely on alternatives such as expensive payday lending and check cashing services to send and receive money.

Being excluded from banking impacts every aspect of a person's life, from having a credit card to making it hard to buy from online vendors. It means being monetarily crippled. Invariably, it also means imposing fees on the people who can least afford them.

The good news is that things are changing quickly. Peter C. Pollini, PWC Principal, had this to say about the change:

The financial-services industry is in the midst of a significant transformation, accelerated by the COVID-19 pandemic. And given the key role digitisation plays in the financial lives of more and more of the world's population, electronic payments are at the epicentre of this transformation.

Payments are increasingly becoming cashless, and the industry's role in fostering inclusion has become a significant priority. Payments also are supporting the development of digital economies and are driving innovation-all while functioning as a stable backbone for our economies.

Though the older institutions may wish to cling to the status quo, the financial services industry is experiencing a metamorphosis. With so many alternatives now available to unbanked customers, the traditional banking system needs to either adapt or be replaced.

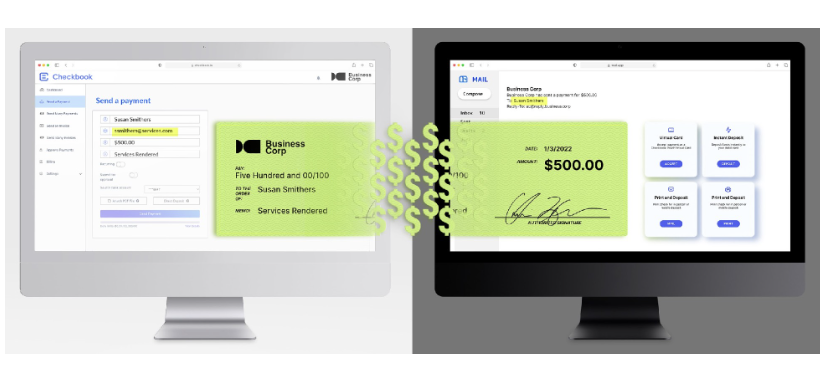

Checkbook is an example of a solution challenging the old banking model. By offering businesses a way to disburse and monitor payments digitally in real time, they've positioned themselves as a viable solution for companies of all sizes to serve both banked and unbanked customers in the rapidly changing financial market. Checkbook helps companies with instant digital payment solutions that are convenient for their customers, democratizing a process that has for too long excluded millions of people.

Checkbook offers a variety of ways to send payments, from traditional mailed checks and checks that can be printed at home to virtual cards, which do not require a bank account and can be used instantly-the only truly digital option that does not require bank information. With Checkbook's services, recipients do not need to create an account or enroll to get paid; each secure transaction can be handled with only an email, phone or address.

Unlike other digital payments companies on the market that focus on one or two payment delivery options, Checkbook's all-in-one push payments platform offers a full spectrum of secure disbursement options with no percentages, hassles or hidden fees, including:

-

direct deposit: In a 2020 "Getting Paid in America" survey, 93% of respondents said they get paid through direct deposit. Checkbook's ACH direct deposit offers a simple solution for transferring money directly to the recipient's bank with just a routing and account number.

-

printable checks: Checkbook's printable checks eliminate print and postage costs by allowing the receiver to receive a digital check by email in seconds. The recipient can print the check and deposit it into their account.

-

real-time payments: Real-time payments allow recipients to receive funds in less than 60 seconds through the RTP network provided by The Clearing House. Like ACH payments, real-time payments use bank routing and accounting numbers to transfer funds, so upgrading to this faster option from ACH payments is automatic for the banks that have already adopted it.

-

instant pay: With Instant Pay, recipients can have payments transferred directly to their VISA or MasterCard branded debit or ATM card in seconds. This is a convenient and secure payment option for recipients who prefer not to give out sensitive banking information or don't want to wait for their payment. They only need to put in their debit card information to receive their payment instantly.

-

virtual credit cards - Virtual credit cards (VCC) are unique 16-digit card numbers generated to make payments like a regular credit card. But unlike a traditional credit card, sensitive account information associated with the card is kept private. It does not require a bank account, and it can be used anywhere Visa or Mastercard are accepted. Receiving funds for the virtual credit card associated with your account is easy and instant.

-

traditional paper checks - For those more comfortable sending and receiving payments with paper checks, Checkbook's traditional paper check option is ideal for businesses that still need an offline system.

Sending and receiving payments efficiently and safely shouldn't be difficult. Checkbook combines financial expertise, customer experience, security, and compliance standards for businesses and individuals seeking a comprehensive payment solution with real-time capabilities.

"Checkbook democratizes money. Our technology can send and receive payments faster, securely and without requiring sensitive banking information. This opens up the world of digital payments to people who would never have been able to access them in the past."

-

P.J. Gupta, Founder & CEO, Checkbook

Businesses of all sizes and industries benefit from Checkbook's convenient payment options. A few examples include:

-

Insurance companies (claims disbursements)

-

Law firms (class action lawsuit payouts)

-

Financial services (loan payouts, pay early, earned wage access)

-

Real estate (rent collection)

-

Gig economy (paying contractors)

For companies ready to move away from traditional financial systems that overlook much of the population, Checkbook offers an easy-to-use platform with flexible solutions that are convenient, faster and secure.

To learn more about Checkbook and how they are helping businesses level up their payment options and better support the needs of their customers and clients, visit their website.

* This is a contributed article and this content does not necessarily represent the views of techtimes.com