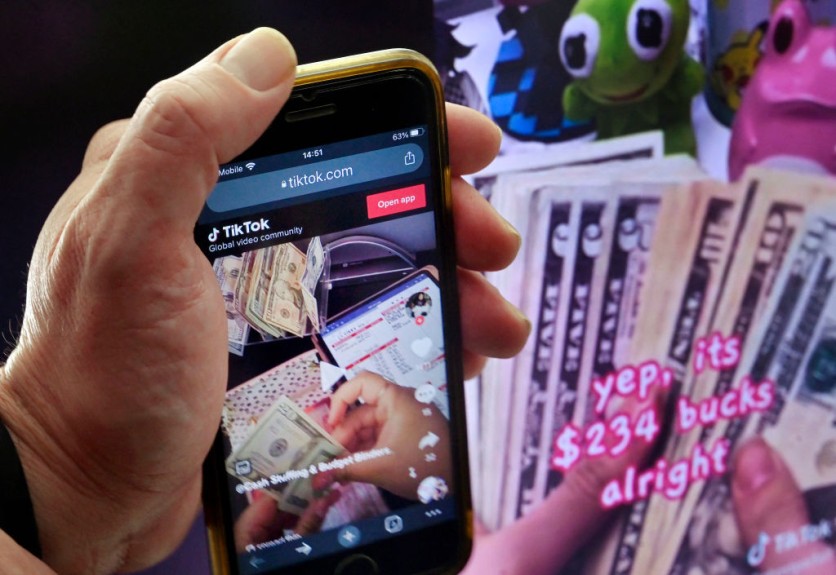

Is TikTok Shop, the e-commerce marketplace of the popular short video app TikTok, surpassing established players Shopee and Lazada in Southeast Asia? This emerging threat has caught the attention of industry experts and analysts, according to a report by CNBC.

TikTok's parent company, ByteDance, is actively expanding the short video app's presence in markets beyond the United States and India, aiming to diversify revenue streams.

As part of this strategy, TikTok Shop enables merchants, brands, and creators to sell their products to users on the platform.

TikTok Shop in Southeast Asia

Since its launch, TikTok Shop has made significant strides in the Southeast Asian market. It expanded to six countries in the region, including Singapore, Malaysia, Indonesia, the Philippines, Vietnam, and Thailand.

The platform's growth has been remarkable, with its gross merchandise value (GMV) skyrocketing to $4.4 billion in 2022, based on internal data obtained by tech media outlet The Information.

However, it is important to note that TikTok Shop's current GMV is still considerably lower than that of Shopee and Lazada. Shopee recorded a staggering $73.5 billion in GMV in 2022, while Lazada reached $21 billion for the year through September 2021, according to CNBC.

Despite the significant lead of its competitors, TikTok Shop poses a threat. The platform continues to grow rapidly, attracting both large and small users who leverage its reach to connect with new customers.

With over 135 million TikTok users in Southeast Asia alone, according to market research company Insider Intelligence, the potential customer base for TikTok Shop is substantial.

Indonesia, in particular, stands out with the second-largest population of TikTok users after the United States. The country boasts around 113 million TikTok users, driven by its sizable young population.

Meanwhile, Shopee's parent company, Sea Group, is relying on the e-commerce platform to bolster its balance sheet amid declining revenues in its gaming arm. Shopee is actively expanding its presence in Malaysia and strengthening its operations in Brazil as well.

Read Also : TikTok CEO Gets Grilled in Congress Hearing About App's Ban In the US; COO Claims 'Xenophobia'

TikTok's Influence on Consumer Behavior

While TikTok Shop's rise is evident, a survey conducted by retail insights company Cube Asia finds an interesting trend. Consumers spending on TikTok Shop have reportedly reduced their expenditures on Shopee (-51%), Lazada (-45%), and offline shopping (-38%) in Indonesia, Thailand, and the Philippines.

This shift highlights the impact of TikTok Shop's growing influence on consumer behavior.

As TikTok Shop continues its expansion and gains traction in Southeast Asia, it poses a potential challenge to the established dominance of Shopee and Lazada. With its unique combination of short videos and e-commerce capabilities, TikTok Shop has tapped into a new avenue for online shopping that appeals to the region's millions of users.

The competition among these e-commerce players is set to intensify, driving innovation and benefiting consumers with more choices and possibly improved services.

Related Article : Experts Say TikTok Ban on Australian Government-issued Phones Should Also Apply To Other Social Media Apps

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.