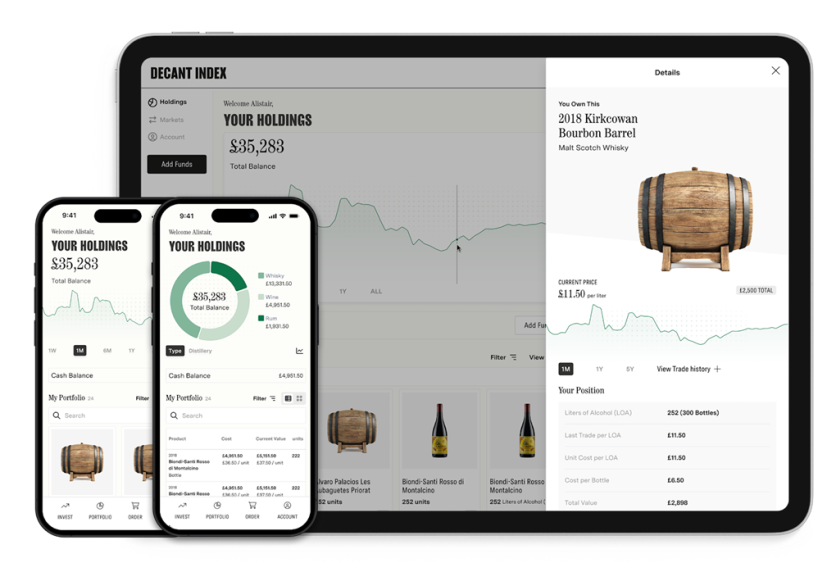

Whisky has entered a new phase. No longer confined to distillery tours or the cabinets of connoisseurs, it is now available as a transparent, data-driven asset. Decant Index, developed by Decant Group, enables investors to buy, track, and manage fine spirits portfolios through a single platform. With over $126 million in assets under storage and a growing base of 44,000 members, the online marketplace and app is giving individuals structured access to one of the more unique corners of alternative investing.

Decant Index connects users to curated bottles of investment-grade wine and spirits while also offering real-time performance monitoring, tax-efficient gains, and secure physical storage through Decant Bond—Decant Group's privately owned warehouses in Alloa, Scotland. This digital tool not only opens doors to premium spirits—it also offers a system that supports long-term asset management grounded in cultural heritage.

Building Transparency into Tradition

Alistair Moncrieff, CEO of Decant Group, stated, "We built Decant Index to let investors connect with whisky as a tangible, story-rich asset, not just a commodity."

Investment begins at $2,500. This entry point was deliberately chosen to encourage new investors to access a market that was once out of reach. As of early 2025, more than 1,618 exits have been facilitated on the platform, and these transactions have returned over $6.1 million to clients.

Investors in the UK benefit further from the capital gains tax exemption applicable to whisky, which is classified as a wasting asset. This offers a key advantage over more volatile or regulation-heavy asset classes. Many users of Decant Index are entering the alternative investment space for the first time. For them, whisky represents something tangible, relatively stable, and tied to a deeper cultural identity.

A Digital Journey Across Whisky Regions

Scotland's whisky production is rooted in geography. Decant Index integrates this knowledge directly into the app, offering users an educational experience alongside investment opportunities.

Lowland distilleries such as Glenkinchie are known for a lighter style. Port of Leith, a vertical distillery in Edinburgh's harbor, adds architectural interest. Islay selections include Lagavulin, which is recognized for its strong peated profile and views of the bay. Talisker, located on the Isle of Skye, delivers a spicy and maritime character. Its recently updated visitor center speaks to the ongoing relevance of heritage producers.

Speyside entries include The Glenlivet, named "Scotland's Leading Whisky Distillery Tour" in 2023, and The Macallan. The latter operates from a 485-acre estate where the distillery is shaped to blend into its surrounding hills. These brands form the backbone of the investment-grade spirits on offer through Decant Index.

Each bottle listed is paired with detailed production notes, origin information, and valuation insights. This not only helps investors make informed decisions but also connects them to the wider narrative of whisky production in Scotland.

Decant Bond — Infrastructure That Strengthens Trust

Physical assets require proper storage. Decant Group addressed this in 2024 by launching Decant Bond—a bonded warehouse facility in Alloa, Scotland, equipped with systems designed to monitor climate and security. It became operational in June.

This facility plays a critical role in preserving the value of investment-grade whisky. Internal monitoring regulates temperature and humidity. Clients receive regular updates through the Decant Index platform. By overseeing the full chain of custody, from acquisition through maturation, Decant Group ensures that stored assets remain in peak condition.

This infrastructure resolves one of the main concerns in the whisky investment sector: long-term asset integrity. Unlike speculative digital assets, whisky requires protection over time. Decant Index delivers this security through Decant Bond with fully insured warehouses licensed and audited by HMRC.

Expanding Beyond Scotland

Decant Index continues to broaden its portfolio. Its next area of focus is the American market, where premium whiskey has experienced strong momentum. According to the Distilled Spirits Council, super-premium American whiskey brands saw a 17.8 percent increase in sales in 2023.

Premium rum has also been introduced to the platform, targeting growing demand among collectors and investors in the US and Europe. In parallel, Decant Index recently launched a personalized wine cellar subscription starting at $330 per month. This option allows users to build a bespoke wine portfolio according to their taste preferences and investment strategies.

Each new category supports the app's mission: to create access to collectible, story-driven spirits in a format suitable for structured investment. The goal is not only to broaden the scope of participation but also to deepen users' understanding of the assets they hold.

Decant Group's New E-commerce Platform: House of Decant

Soon to launch fully into the market, House of Decant is Decant Group's dedicated e-commerce platform — luxury retail, reimagined.

It offers a curated, concierge-led experience with fast delivery, flexible subscriptions, and a home for both heritage labels and emerging brands.

"We're building a platform that redefines how premium wine and spirits are discovered, purchased, and enjoyed—tailored for the expectations of the modern luxury consumer," says Chris Seddon, Managing Director of Decant Group.

Shop with House of Decant here.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.