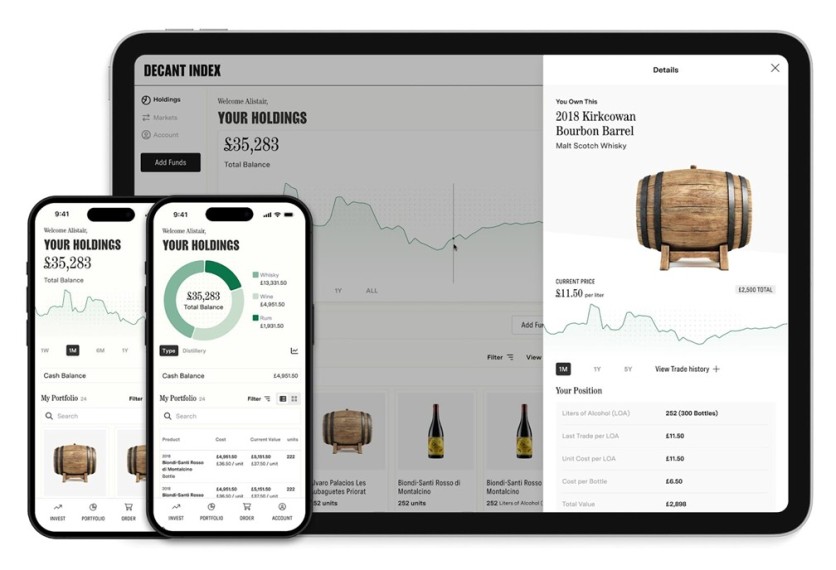

Collecting fine spirits has long been viewed as a pursuit for connoisseurs and collectors. Decant Group is changing that perception with Decant Index, a digital platform that lets users manage portfolios of wine and spirits as structured, traceable assets. With more than $126 million in assets under storage and 44,000 members globally, the company is offering a broader audience access to a previously exclusive segment.

Decant Index provides access to carefully selected bottles of investment-grade wine and spirits. Users can monitor performance in real time, receive tax-advantaged returns, and benefit from secure, physical storage at Decant Bond—Decant Group's bonded warehouse in Alloa, Scotland. This service is designed to simplify the process of collecting spirits while preserving authenticity and origin.

Making Tradition Accessible

"We built Decant Index to let users engage with spirits as culturally significant holdings, not just as commodities," said Alistair Moncrieff, CEO of Decant Group. The platform's minimum entry of $2,500 was set to allow new participants to explore this space.

As of early 2025, Decant Index has facilitated 1,618 exits and returned over $6.1 million to clients. Investors in the United Kingdom also benefit from capital gains tax exemptions, as spirits are considered wasting assets. This offers an edge over traditional financial instruments, which often carry higher regulatory and tax burdens.

First-time users often choose Decant Index as a starting point in alternative assets. Spirits provide a tangible connection to history, regional craft, and a relatively stable store of value.

Region, Story, and Selection

Geographic identity plays a central role in spirit selection. Decant Index includes regional and educational information that helps guide users through curated options. From the lighter expressions of Lowland distilleries like Glenkinchie to the modern, vertical structure of Port of Leith in Edinburgh, regional variation is central to the platform's listings.

Islay entries such as Lagavulin are known for bold peat-forward profiles, while Talisker, based on the Isle of Skye, is distinguished by its maritime spice. Speyside's well-known distilleries include The Glenlivet, which was named Scotland's Leading Whisky Distillery Tour in 2023, and The Macallan, which operates from a 485-acre estate shaped to mirror the surrounding hills.

Each bottle includes detailed production notes, historical context, and valuation data. This enables users to make informed decisions while gaining insight into craftsmanship and regional identity.

Protecting Value with Decant Bond

Decant Group addressed one of the key challenges in spirit collection—secure storage—by launching Decant Bond in 2024. Operational since June, the bonded facility in Alloa is equipped with systems to monitor temperature, humidity, and security.

Clients can follow the condition of their holdings via the Decant Index platform. Full custody is maintained from acquisition through aging. Warehouses are fully insured, licensed, and audited by HMRC. Decant Bond was designed to safeguard the long-term value of each bottle stored under its care.

Expanding the Catalogue

Decant Index is also expanding beyond Scotland. American whiskey has gained momentum among collectors. According to the Distilled Spirits Council, super-premium American whiskey brands recorded a 17.8 percent increase in sales in 2023. In response, Decant Index has added select American labels to its marketplace.

Premium rum has also been introduced. Demand is increasing in both Europe and the United States. To further diversify offerings, Decant Index launched a personalized wine cellar subscription starting at $330 per month. This allows members to curate a wine portfolio aligned with both taste preferences and collection goals.

Decant Group's New E-commerce Platform: House of Decant

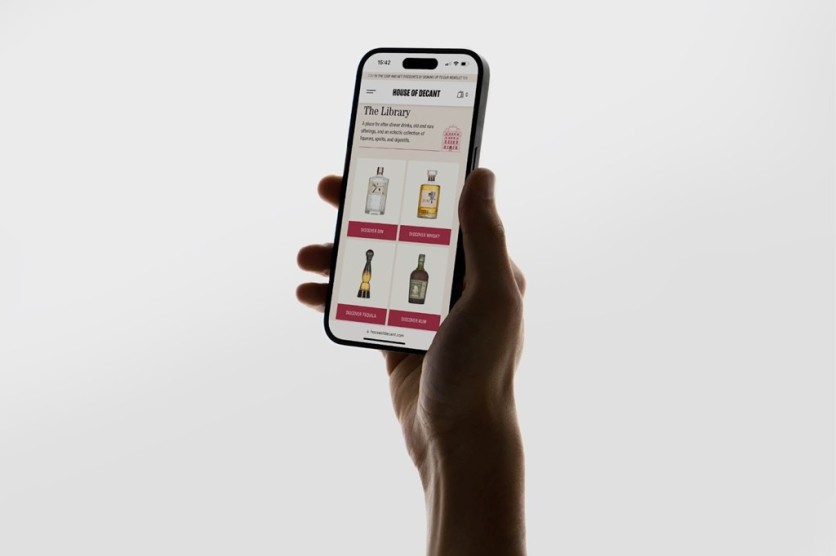

Decant Group is preparing to launch House of Decant, an e-commerce channel for collectible bottles. The online store will offer premium selections, fast delivery, and concierge-style customer service. It is designed to complement the firm's investment platform while also reaching a broader audience.

Chris Seddon, managing director at Decant Group, said the company is focused on adapting to evolving consumer expectations. "We are building a platform that changes how premium wine and spirits are discovered, purchased and enjoyed—designed for what today's luxury consumer expects."

Learn more about what House of Decant has to offer here.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.