Investor sentiment remains fragile after October's record liquidation event wiped out billions in leveraged positions, leaving traders cautious as Q4 begins. Yet, despite the uncertainty, Bitcoin continues to outpace traditional benchmarks, up 18% year-to-date in 2025, compared to the S&P 500's 10%.

Now, all eyes are on macro catalysts that could shape Bitcoin's next move. The Federal Reserve's upcoming rate decisions, along with performance in the Nasdaq and broader tech sector, are poised to influence risk appetite across markets. Historically, periods of easing monetary policy and a rebound in tech equities have coincided with renewed momentum in Bitcoin. As the final quarter unfolds, the interplay between Fed cuts, liquidity conditions, and investor rotation into digital assets may determine whether Bitcoin's rally regains steam or stalls into year-end.

Buyers Reentering the Market

As Bitcoin consolidates around $110,000, the asset has repeatedly tested the sub-$110,000 level amid shifting market conditions. The recent liquidation event resulted in a 30% decrease in open interest. However, open interest resets are indicative of a healthier market, enabling re-risking and providing an avenue for organic market recoveries.

Liquidity has been absorbed on both the higher and lower range, establishing $112,300 as a key resistance level to break. Analysts emphasize that the lower range of $104,000 provides a consistent case for a potential lower-time-frame bottom. Additionally, Rekt Capital emphasizes that the CME gap has been filled in the $110,000 range, a development that could impact future price movements.

Glassnode data highlights renewed interest in Bitcoin purchasing. Wallets holding 1–1000 BTC have increased their buy orders. At the same time, major BTC holders who sold during the downturn are regaining positions, signaling they may be positioning for a price recovery. Wider sentiment among expert traders presents a potential accumulation phase that could precede a breakout.

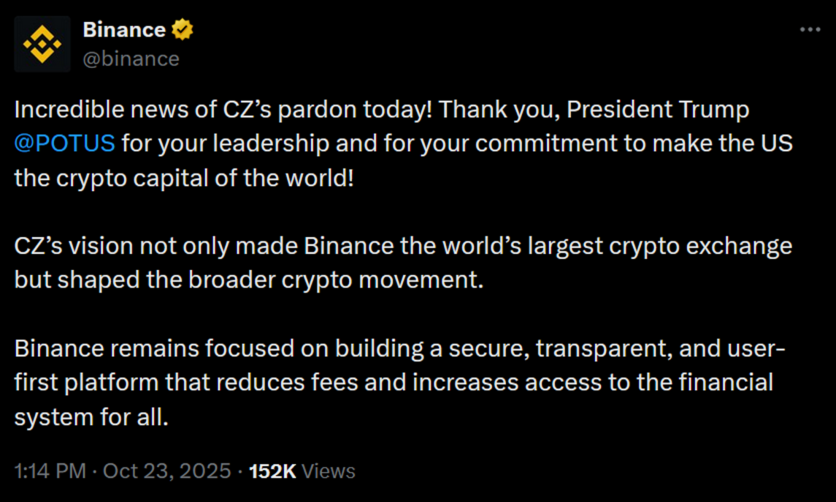

Couple this with the recent news of Binance co-founder Changpeng Zhao being pardoned by President Trump, showing that the US is committed to removing regulatory uncertainty from the market. BNB price jumped 6% as the news came out. In a statement on X, Binance posted, "Incredible news of CZ's pardon today! Thank you, President Trump @POTUS, for your leadership and for your commitment to make the US the crypto capital of the world! CZ's vision not only made Binance the world's largest crypto exchange but shaped the broader crypto movement. Binance remains focused on building a secure, transparent, and user-first platform that reduces fees and increases access to the financial system for all."

Federal Reserve Easing Cycle Creates Uncertain Backdrop

Monetary policies are designed to strengthen investors' confidence in risk-on assets such as Bitcoin. Data on upcoming rate cuts show a 96.7% chance of a continuous 25-basis-point reduction, emphasizing the prospect of a new Bitcoin rally leading into the year's end. However, September's rate cut appeared to be priced into the market, with Bitcoin only rising to $117,000. Analysts linked the muted market response to political pressures, including President Trump's policy stance, and to a weaker-than-expected jobs report.

Despite confidence in rate cuts, analysts underscore an opposite effect. Earlier rate cuts occurred when the Fear and Greed Index was at a neutral level of 51. The market-wide liquidation not only erased $450 billion from the crypto market but also weakened investor confidence. With the index now indicating extreme fear at a reading of 34, attention turns to past Q4 performances, during which Bitcoin posted returns of 15–20% since 2019.

Adding to the perplexity is the prolonged risk of the government shutdown. Government uncertainty can spill into the Fed's decision-making process or dampen expectations for a renewed bullish reversal. Experts also hint that market conditions could trap top buyers, underscoring lingering uncertainty in the broader market outlook. As such, the Fed's decision could indicate whether Bitcoin can mirror its historically strong Q4 performances.

Crypto and Tech Dependency

Bitcoin's tight correlation with technology stocks emerged as a primary risk factor for the cryptocurrency's near-term trajectory. Bitcoin's 92% correlation with the NASDAQ underscores its growing interdependence with traditional risk assets. However, Bitcoin and the broader market have mirrored tech stocks, only occasionally showing signs of potential decoupling.

Bitcoin's correlation with the S&P 500 tightened to 0.86 in 2025, up from 0.75 in 2024, reflecting Bitcoin's maturation as a macro asset. Renewed tariff discussions prompted broad market liquidations, revealing a strong correlation. The S&P 500 dropped 2.7% and Bitcoin fell 8.17% over 24 hours. Furthermore, Bitcoin-Nasdaq divergences were followed by rapid BTC recoveries, consistent with the cryptocurrency's intrinsic fundamentals. Given the decline in crypto investor sentiment, a potential crypto recovery would depend on improved performance in technology and broader equity markets.

Historical Q4 Seasonality

Since 2013, Bitcoin has averaged 79% returns in Q4, making it the strongest quarter of the year. In 2025, ETFs attracted over $28 billion and became the main drivers of market liquidity.

Jurrien Timmer of Fidelity echoed this sentiment, emphasizing growing interest in Bitcoin ETFs.

Recent data shows inflows exceeding $5 billion even amid market uncertainty. As such, Q4's success hinges not on institutional support, which has remained consistent in 2025, but rather on the Fed's decision and overall stock market performance.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.