Chinese semiconductor design companies are reportedly turning to Malaysia for the assembly of a portion of their high-end chips, known as graphics processing units (GPUs). A move to limit financial risks amidst US' export restrictions as per Reuters' sources.

According to the cited sources, China's demands do not concern the production of the chip wafers; rather, Malaysian firms will only take part in relation to the chips' assembly, thus not in violation of any of U.S. limitations. Reuters adds that certain contracts for such demands, have already reportedly been agreed-upon.

Washington has reportedly been putting more and more limitations on the sales of high-end GPUs, as well as on advanced chip-making equipment, in an effort to deny China access to these vital components, which the administration claims to lead to advances in artificial intelligence or power supercomputers and military applications.

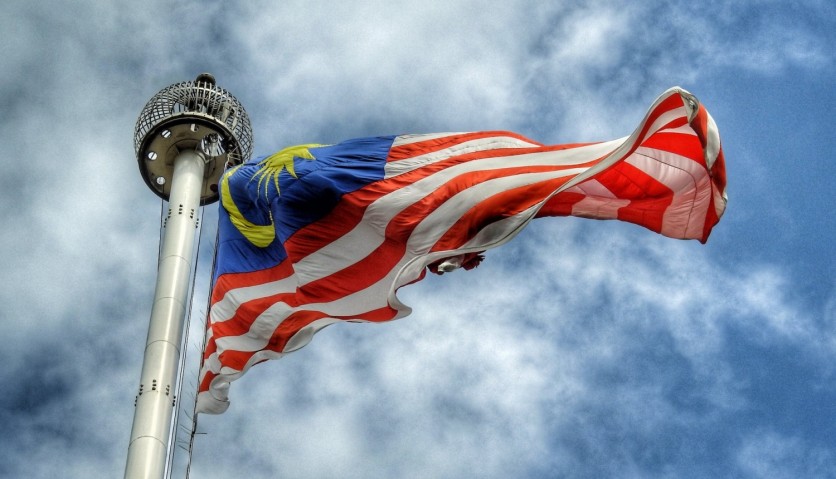

Amidst these restrictions, China has turned to Malaysia, a major semiconductor supply chain hub, as Chinese chip companies look to expand their operations outside of China to meet assembly demands.

Malaysia is reportedly favorably seen by Chinese chip design companies because of the nations favorable relations with China, low cost, skilled labor force, and advanced machinery.

Reuters adds that Unisem, which is mostly controlled by Huatian Technology in China, along with other chip packaging businesses in Malaysia have witnessed a surge in business and queries from Chinese customers.

Unisem Chairman John Chia said that several Chinese chip design organizations have gone to Malaysia to develop extra sources of supply outside of China to support their operations in and out of China, but he declined to speak on the company's clients owing to supply chain concerns and trade penalties.

Malaysia as an Alternative Chip Manufacturer

A Nikkei Asia report from September proves to echo this notion as Malaysia, with U.S.-China tensions rising, has seen unprecedented amounts of foreign direct investment, mostly attributable to multinational IT and semiconductor businesses. Prior to the historic chip crunch caused by the pandemic, the nation authorized 71.4 billion ringgit ($15.25 billion) in foreign direct investment (FDI) in the first quarter of 2023-more than twice as much as the 32.4 billion ringgit recorded for the entire year 2019.

As the sixth-largest source of semiconductor exports, Malaysia is already a key center for the last stages of the chipmaking process, accounting for 13% of the worldwide market for packaging, assembly, and testing services, according to the government.

China's Efforts on America's Export Curbs

China proves to have diversified its chip manufacturers from different countries, but other Chinese firms prove to have slip past US export curbs as well.

Brite Semiconductor, a top Chinese chip designer, is reportedly buying American software and has financial assistance from the United States. According to Reuters, Brite has backing from a Christian university and a U.S. venture capital business backed by Wells Fargo. It also continues to have access to critical U.S. technology from two software companies located in California, Synopsys and Cadence Design.

Reuters states that it has not seen any proof that Brite's business dealings with American companies are in violation of Biden's export curb.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.