The technology workforce is evolving. Seasoned engineers, developers, and executives are stepping away from traditional employment models to embrace life as independent contractors. This shift is not just about flexibility in hours, projects, or location—it represents a fundamental redefinition of professional and financial independence.

What many overlook, however, is that independence in work also creates independence in wealth-building. As self-employed business owners, contractors have access to retirement strategies that far exceed the limitations of the standard corporate 401(k). By structuring a defined benefit or a cash balance plan, contractors can contribute amounts that are often several times higher than traditional limits—frequently between $100,000 and $300,000 annually.

The implications are profound. For professionals in the top federal tax bracket, this translates into immediate tax deferrals ranging from $37,000 to over $110,000. In high-tax states like California, the benefits multiply further, adding another $13,000 to $39,000 in potential savings. These are not abstract numbers—they represent capital that remains in your ecosystem, compounding for your future rather than being lost to the tax code.

The Power of Advanced Retirement Structures

At the center of this strategy are cash balance plans and defined benefit plans—structures that function like a supercharged 401(k) for independent contractors filing a Schedule C. Unlike traditional retirement accounts, these plans are highly customizable and based on a blend of factors: age, compensation history, IRS-published interest rates, and even mortality assumptions.

An actuary typically develops the roadmap—calculating annual contribution limits and the total potential contributions across a five-to-ten-year horizon. The result is a plan designed not just for compliance, but for maximum wealth accumulation and tax efficiency.

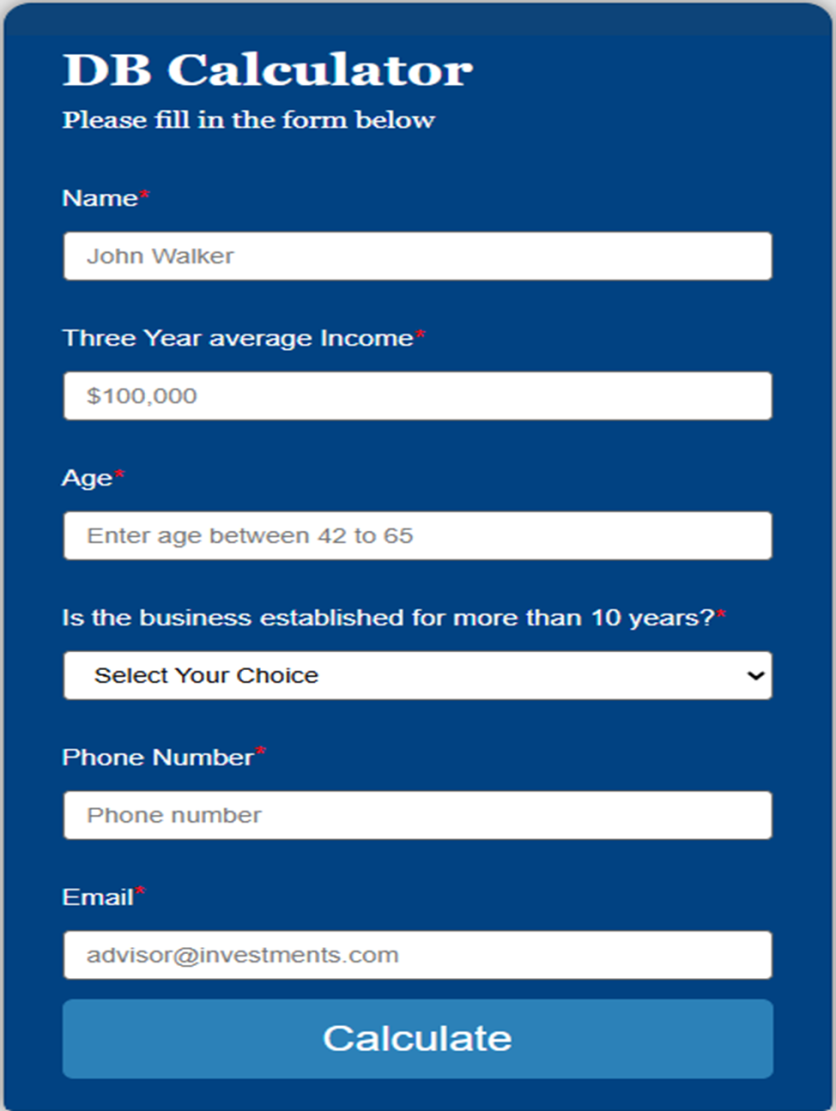

To streamline this process, Pension Deductions has built a proprietary online defined benefit calculator—an innovation that distills complex actuarial math into a few simple inputs. By entering their age and three-year average compensation history, prospective clients can instantly estimate their maximum annual contributions and the longer-term funding potential of their plan.

But technology is not the only part of the story. Pension Deductions also provides end-to-end services, guiding clients through every stage—from plan design and setup to ongoing administration, IRS reporting, and compliance. Clients remain the trustees of their plan assets, maintaining full control over their investments. Eligible investment options include stocks, bonds, ETFs, and mutual funds, giving professionals the freedom to align retirement strategies with their broader investment philosophy.

Getting started is easier than most people realize. Once you've run the numbers with Pension Deductions' online calculator and seen the potential tax savings, the next step is putting the plan in place.

Step 1: Assess & Design

Work with an actuary to evaluate your income history, retirement goals, and eligibility. A customized plan is designed around your age, earnings, and IRS limits.

Step 2: Draft & Establish

Plan documents are prepared, and a trust account is opened. This formalizes the plan and allows you, as trustee, to direct investments.

Step 3: Fund & Maintain

Make your first contributions and keep the plan compliant through annual valuations, IRS filings, and required updates. Professionals handle the administration—so you can focus on growing your wealth.

A New Era of Financial Independence

The rise of independent contracting in the tech world is more than a career choice—it's a structural shift in how professionals live, work, and build lasting security. Those who understand the financial advantages of this independence are uniquely positioned to accelerate wealth creation, minimize tax exposure, and design retirement strategies that rival even the most generous corporate benefits.

Cash balance and defined benefit plans are not just tools; they are catalysts. They enable contractors to capture the rewards of years of expertise and transform high incomes into long-term wealth. With the right structure, the flexibility that drew professionals to independence in the first place can extend far beyond lifestyle—it can shape their legacy.

At Pension Deductions, we believe the future belongs to those who not only adapt to the evolving world of work but also leverage its opportunities for financial growth. That's why we've developed technology, expertise, and end-to-end services designed to make advanced retirement planning accessible to the independent professional.

If you're an experienced contractor or self-employed professional looking to take control of both your work and your wealth, the time to act is now. Explore the possibilities with our online calculator, and let our team guide you through building a plan that aligns with your vision for the future. Your career gives you flexibility, and your retirement plan can give you freedom.

Contact Info:

Email: info@pensiondeductions.com

Website: www.pensiondeductions.com

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.