Amazon's four-day Prime Day event, running this Tuesday through Friday, is expected to generate nearly $24 billion in U.S. online sales, thanks to a surge in mobile shopping and AI-powered bargain hunting.

According to Adobe Analytics, online sales from July 8 to 11 will see a 28.4% year-over-year increase and $9.6 billion more than the same period last year. "This is equivalent to two Black Fridays, which drove $10.8 billion in online spend during the 2024 holiday shopping season," Adobe noted in the study. The event, once a flash sale, has evolved into a data-driven, AI-fueled shopping spectacle that is claimed to play a major role in back-to-school and seasonal retail cycles.

"In Adobe's survey, we found that of those who have used AI for shopping, 92 percent said it enhanced their experience, with 87 percent saying that they are more likely to use AI for larger or more complex purchases," Adobe noted in another study earlier this year. "This is reshaping how businesses think about customer engagement, especially with the arrival of AI agents that will be able to handle more complex tasks and make highly tailored recommendations."

AI and Mobile Are Rewriting the Rules of Retail

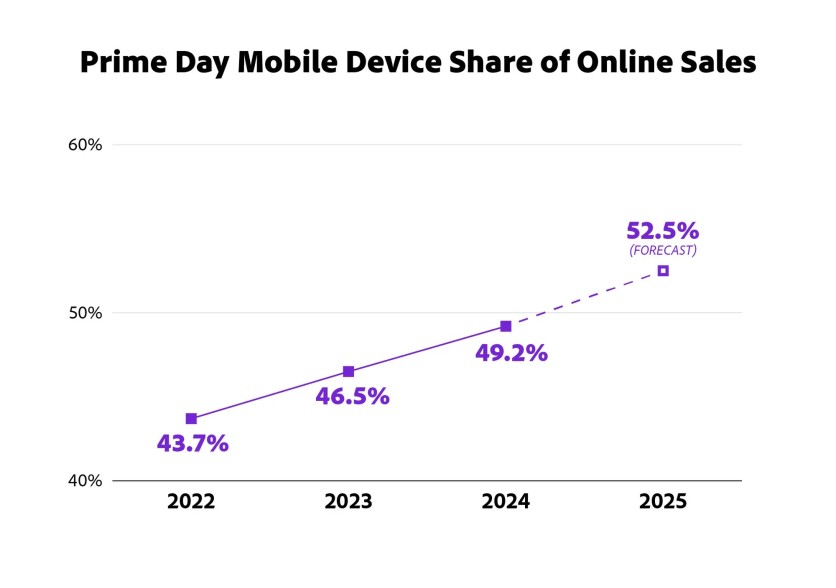

This year's Prime Day falls a week earlier and runs twice as long as last year, anchored by mobile shopping, which is expected to drive $12.5 billion—or 52%—of total sales. Additionally, generative AI tools like chatbots and virtual shopping assistants are reportedly 3,200% more active than last year, spotting real-time deal drops to capture time-sensitive offers. Shoppers are expected to spend more on high-priced items such as electronics, appliances, and sporting goods, attracted by irresistible discounts of up to 24% off apparel and 22% off electronics.

In response to rising demand, Amazon has extended Prime Day's duration and introduced daily themes like "Today's Big Deals." The company is also using celebrity endorsements and brand partnerships with big names like LeBron James and Samsung to draw more attention and drive sales.

Generative AI is becoming a notable source of shopper traffic, drawing in visitors who tend to be more engaged and better informed. Compared to non-AI referrals, Adobe found that AI-driven visitors stay 8% longer, view 12% more pages, and bounce 23% less, indicating a deeper interaction with retail content.

The top reasons consumers use AI include:

- Conducting product research: 55%

- Receiving recommendations: 47%

- Finding deals: 43%

- Gift ideas: 35%

- Discovering unique products: 35%

- Making shopping lists: 33%

This year's Prime Day isn't just bigger, it's smarter, and in all likelihood, will continue growing. Amazon is shifting from sheer volume to high-tech precision, leaning into mobile and AI sources to create a more curated, seamless shopping experience.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.