The crypto industry has finally come of age this year, as traditional financial institutions launched onchain products, blockchains underwent infrastructure improvements, and stablecoin-led payments became a routine phenomenon. In 2026, the global economy is expected to go through further digitalization and enter the next stage of real-world adoption.

In the coming year, more real-world assets are expected to settle onchain with liquidity concentrating onto one or two ultra-fast chains. As the crypto industry shifts toward real utility and governments embrace the sovereign RWA tokenization wave, blockchain companies like Sign will strengthen the foundations for a global onchain financial system.

Stablecoin-led Interoperable Economics

In 2025, stablecoins have become the primary currency of the onchain economy. Unlike previous years, when traders used stablecoins to settle speculative trading, they're now ubiquitously used for remittances and payments.

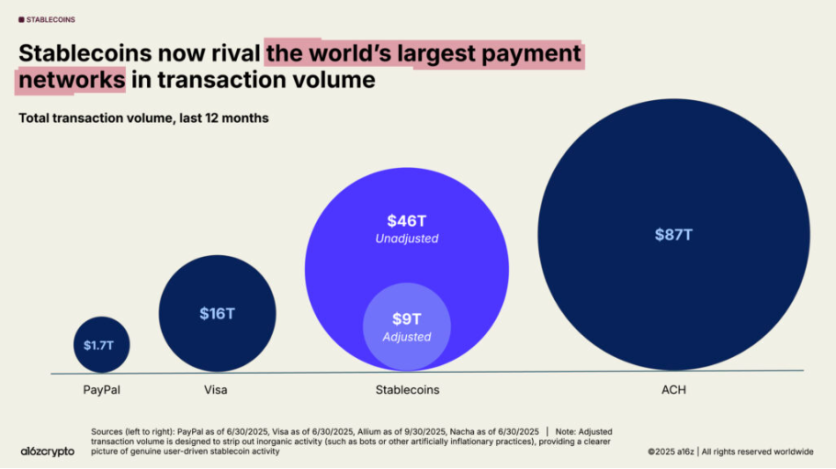

So much so that stablecoin transaction volume has grown 106% in a year to $46 trillion, which is three times that of Visa. After filtering out bots and inflation-led transactions, stablecoins still had five times more throughput than PayPal.

To say stablecoin transactions will increase further in 2026 is an understatement. As governments warm up to stablecoins amidst regulatory clarity, they'll be linked to national payment systems and local currencies.

Sign will spearhead the expansion of the stablecoin ecosystem in 2026 to merge with the broader economy by facilitating mainstream payments.

Eventually, apps will enable users to swap local money for stablecoins and vice versa through seamless integration with regional networks. Equipped with QR codes, real-time payment features, and bank-to-bank settlements, companies will also offer stablecoin-compatible interoperable global wallets and crypto cards.

With stablecoins plugged directly into national payment networks, compliant cross-border payments via Sign can occur in real-time. Merchants, too, can accept stablecoins from international customers without incurring high bank fees, and apps can cater to a global audience with instant payment settlements.

At an infrastructure level, stablecoins will make bank ledgers more efficient in 2026.

Currently, the banking industry's critical databases still run on COBOL-programmed mainframe computers with batch file interfaces. Although regulated and rigorously tested, these systems are not conducive to innovative functionalities such as real-time, cross-border payments.

Stablecoins can enable banks and major financial institutions to update their systems without completely overhauling their legacy frameworks. By providing a new avenue for innovation, stablecoins help institutions retain the benefits of core banking structures without foregoing modern tech.

Tokenization-based Inclusive Finance

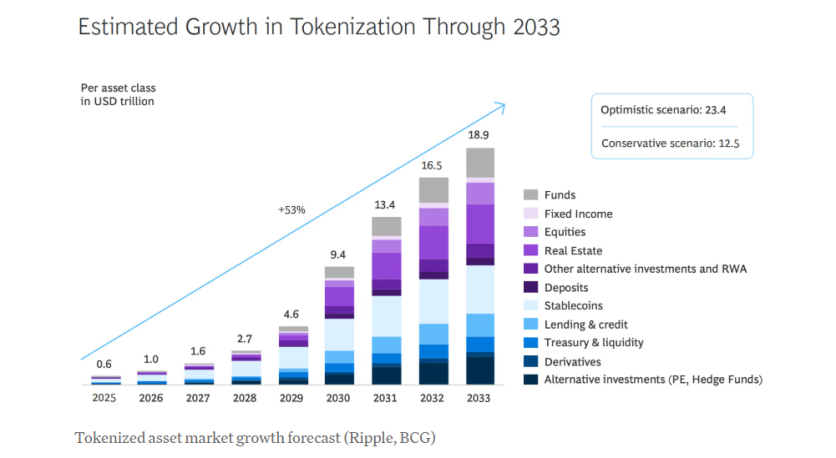

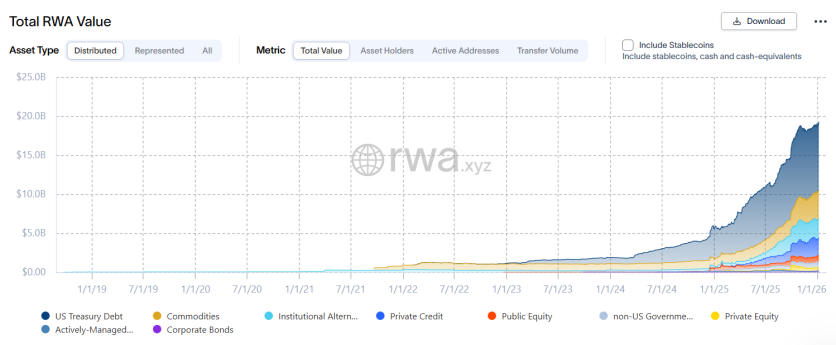

There's already robust interest from fintechs and governments alike to tokenize equities, private credit, and commodities such as oil, gold, and other traditional assets. In 2025, the RWA tokenization market grew to $24 billion by mid-year, with estimated projections of reaching $18.9 trillion by 2033.

Consequently, 2026 will be a year of consolidation for the RWA tokenization sector. So, one can expect to see more origination of onchain tokenized products in the coming months.

For example, tokenized money market funds (MMFs) have grown to $8.6 billion by November 2025, as institutions like JPMorgan and BlackRock adopted them into business strategies. With the CFTC recommending tokenized MMFs as eligible collateral, they'll eventually evolve into institutional collateral in 2026.

Tokenized MMFs are regulatory-compliant and portable across multiple ledgers in real time. With the growth of tokenized cash rails, institutions will be able to transact in tokenized MMFs without converting to legacy payment rails.

In fact, governments and private companies can leverage the Sign product stack to directly originate assets onchain rather than originating off-chain and tokenizing them later. Direct onchain asset origination will reduce overhead servicing costs and back office expenses, while enhancing overall accessibility.

As governments embark on sovereign RWA tokenization via Sign, retail investors will get better access to illiquid market assets such as private equity and pre-IPO companies. Tokenization will empower investors to participate in a compliant manner without constantly shifting between legacy finance and crypto products.

With the rise of tokenization, personalized wealth management, usually reserved for high-net-worth individuals (HNIs), will become more democratic and inclusive. AI-recommended tokenized investment products will rebalance investor portfolios and accelerate RWA adoption at minimal costs.

Blockchain-powered User Services

At the core of the onchain economy are blockchains that run the entire show.

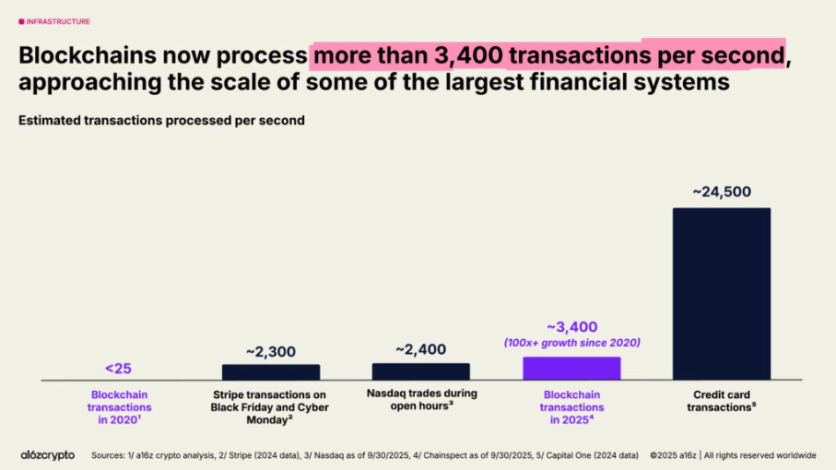

In the last five years, the average transaction throughput across major blockchains has increased more than 100x, from 25 transactions per second (TPS) to 3,400. That is on par with Nasdaq's trades during open hours or Stripe's global throughput during Black Friday sales.

In 2026, there's going to be a further improvement of blockchain infrastructure, and with it, more users will come onchain. The total number of crypto mobile wallet users has already gone up by 20% in the last year, with over 40–70 million active users. In the coming months, more users are expected to join.

The onchain economy has already matured, with one-fifth of spot trading volume happening on decentralized exchanges and perpetual futures up by 8x.

Further, Sign has partnered with the Kyrgyz Republic in 2025 to modernize its financial infrastructure and with Sierra Leone to improve the country's blockchain-based Digital ID and stablecoin payment infrastructure.

They indicate how governments and users are prioritizing real-world use cases over empty speculation and passive holding of crypto assets. Going forward, more government institutions will be looking to adopt blockchain infrastructure to improve their citizen-centric, utility-driven services.

Simultaneously, developers and users are zeroing in on a select few blockchains. For example, Sign's sovereign blockchain infrastructure offers both public and private networks based on a transaction's transparency and privacy requirements. This demonstrates how one or two blockchain networks will dominate the industry as liquidity concentrates within these ecosystems.

Driven by real-world utilities, broader user adoption, and more liquidity influx, 2026 will be the year when the global onchain financial system will enter the next stage of growth and evolution.

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.