With today's technology, when it comes to payment systems, people usually prefer to go cashless rather than carrying physical money.

Wave Mobile Money, a company focused on bringing innovative financial infrastructure, is expanding its service across Africa. The company's CEO, Drew Durbin, and his team aim to transform the region into the first continent to adopt this new financial network.

Let's find out how he arrived at this idea.

Who is Drew Durbin?

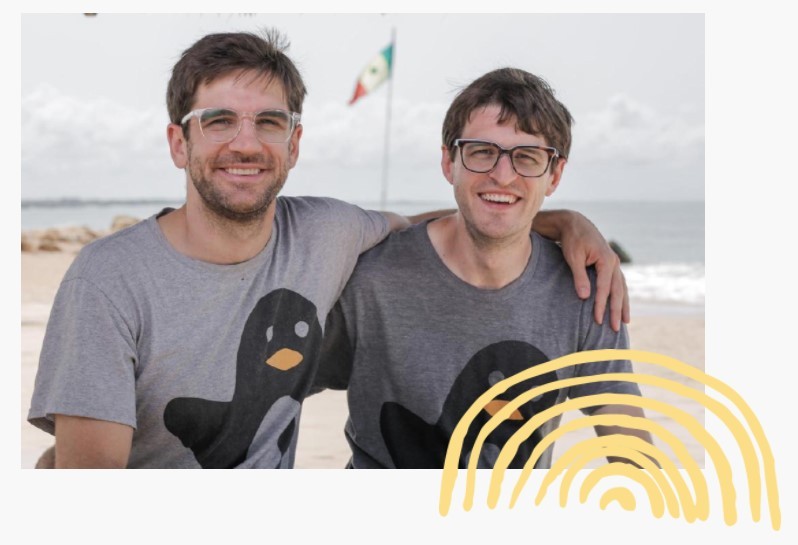

(Photo : Wave)

Drew Durbin (right) and Lincoln Quirk (left).

According to LinkedIn, Durbin is the current founder and CEO of Wave Mobile Money, a firm promoting low transfer costs and fees for African people.

He has been serving the company since January 2018. For nearly five years, he has been dedicating his time to bettering the lives of Africans when it comes to digital finance.

Before becoming the Wave CEO, he founded a digital remittance startup in the region dubbed Sendwave. At that time, it was the largest firm that offered the service in Africa.

In 2020, WorldRemi acquired Sendwave for $500 million. That's the time when Durbin focused his craft on improving the next plan on his list.

He graduated in 2008 from Brown University, the same institution where his fellow Lincoln Quirk graduated. The latter became a co-founder of Wave.

Related Article: #TechCEO: Meet Nigeria's Fintech Pioneer Tayo Oviosu, CEO of Mobile Payments Platform 'Paga'

How Did Wave Start as a Company?

As per the official website of Wave, Durbin and Quirk have been good friends since their freshman year. They have a mutual interest in changing the world by creating "simple" products that impact the community.

From the get-go, the two co-founders have already set their minds to help others and take their talent to west Africa, which lacked financial literacy at that time.

In an interview with Quartz, Wave's Head of Public Policy Rashmi Pillai said that Durbin and Quirk have been targeting to "bring radically inclusive and affordable financial products and services" to the said place.

Upon launching the startup, they have taken drastic steps to bring cheaper payment methods for the citizens. Some firms have been using USSD codes for fund transfer, but Wave is built differently. Instead, the company relies on a QR code system for in-app and card transactions.

Since many people still are facing difficulty in reading USSD codes, the duo arrived with the idea that it is easier to comprehend.

Users are free to download the QR code from the company's official app if they want to set up an account. Wave also hands them a bank card-sized card that houses all of their details.

It's important to know that if you want to use it, you need to input your phone number for confirmation. It also applies to transactions that you will do in the future.

The service that Wave offers is very affordable. Sending funds comes with a 1% only. There's no fee imposed when you are paying for utility bills.

Some companies in Africa have adjusted to Wave's strategy. For instance, MTN Money and Orange Money also implemented a flat 1% fee for the transactions across Cote D'Ivoire and Senegal.

Since they wanted to stay afloat in the competition, they fully changed their strategy to keep up with Wave.

The impact that Wave did on Africa was truly inspirational. Aside from inspiring the competitors, it has given hope to people who have been engaging in financial services daily.

Durbin and Quirk have got a long way to serve the people in line with their long-term vision of improving the financial competence of the continent in the years to come.

Read Also: #TechCEO: Y Combinator Founder Michael Seibel Gives Insightful Tips For Startup Beginners

This article is owned by Tech Times

Written by Joseph Henry