Europe is anticipated to press for the creation of cooperative semiconductor supply chains with the assistance of Taiwanese chip manufacturing oligopolies as tensions between the island and China pose concerns to the stability of Asian chip supplies.

As reported first by the South China Morning Post, Europe is dependent on integrated circuits and microchip supply for its huge industries since the continent lacks a domestic chip manufacturing sector of the size of Asia.

"Wary of becoming victims of a political dispute, European companies are monitoring this increasingly sensitive issue and are assessing the potential risks very carefully," the European Union Chamber of Commerce of China stated in its annual position paper.

The chips are used by businesses like Netherlands-based Stellantis for electric vehicles, while French aerospace company Airbus relies on them for aircraft technologies.

West-Friendly Network

The coronavirus pandemic increased demand for electronic devices, but the tech industry struggled to keep up due to a chip shortage. The problem is now coming up again for Europe as a result of fresh geopolitical tensions between the West and China.

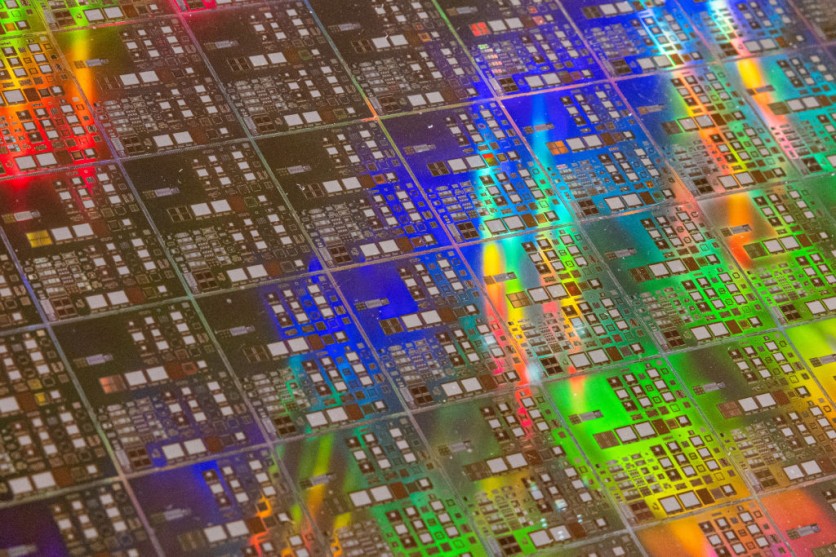

About 60% of the world's semiconductors are produced in Taiwan, and these products have become key in a developing tech conflict between Beijing and the West, as noted by the SCMP.

Now, Taiwanese semiconductor producers find themselves in the middle of a brewing conflict.

According to British market research firm Strategy Analytics, Europe purchases 80 to 95 percent of its produced chips from sources outside the European Union (EU), a majority of them are from Asia.

Analysts anticipate that Europe would restructure its import routes for semiconductors so that chips pass through a network of nations and contract manufacturers that are friendly to the West.

Brady Wang, an analyst with Counterpoint Research in Taipei, said that this network might also encompass Malaysia and Vietnam.

Malaysia's machine and equipment manufacturing sector is expanding, while Vietnam serves as the primary manufacturing location for multinational tech giants like Foxconn Technology and Samsung Electronics, which are both based in Taiwan.

"China and non-China"

Wang added that the best course of action is to stay away from policers because customers are forced to divide supply chains into "China and non-China."

Analysts predict that firms like Taiwan Semiconductor Manufacturing Co. (TSMC) and United Microelectronics (UMC) will be forced to join supply networks that are favorable to the West.

UMC, which reported $6 billion in revenue last year, stated earlier this month that it plans to develop a "diversified manufacturing footprint" that will allow it to streamline logistics and provide enhanced service to international customers.

With $61.5 billion in revenue last year and the ability to manufacture some of the most cutting-edge semiconductors on the market, TSMC is the largest contract chip manufacturer in the world.

Read also: Acer: Global Chip Shortage to Happen Until 2022-Laptop, Semiconductor Production Faces Crisis

This article is owned by Tech Times

Written by Joaquin Victor Tacla

ⓒ 2026 TECHTIMES.com All rights reserved. Do not reproduce without permission.